The "Second Chance" Entry 📉🔄

Why $MP and Mining Stocks are a buy on the pullback.

📰 In This Issue…

The "Easy Money" breakouts are over. Now comes the "Smart Money" retest. We are tracking a specific setup today: The Pullback to Support.

While the general market chases highs, we are looking at Strategic Assets (Rare Earths, Coal, and Critical Minerals) that have broken out and are now coming back to test their moving averages. This is where you manage risk and build a position.

Inside this edition:

-

The Headliner: $MP ( ▲ 9.31% ) Materials—The Western Rare Earth leader gives us a "Double Bottom" entry.

-

The Sector Rotation: Why the market is re-rating Coal ( $BTU ( ▲ 3.01% ) ) and Minerals ( $UAMY ( ▲ 22.77% ) ) from "Old Economy" to "AI Infrastructure."

-

🔒 Premium Only: The Antimony & Niobium swing trades ( $UAMY ( ▲ 22.77% ) , $NB ( ▲ 21.75% ) ) and the Gold/Copper breakout ( $MUX ( ▲ 9.34% ) ).

Buy the pullback. Ride the trend.

🏆 Top Setup of the Day

$MP ( ▲ 9.31% ) – Long term trade

The Context: MP Materials owns the only scaled rare earth mining and processing site in North America. They are the "Anti-China" trade for EV magnets and defense tech. With the West desperate to onshore its supply chain, MP is a national security asset.

The Setup: The stock has formed a classic Double Bottom one month later and is now pulling back to test the 50-Day Moving Average.

-

Strategy: Do not enter fully yet. This is a "Progressive Entry." Buy a starter position here at support. Only add more when the stock proves you right and moves in your favor.

MP Daily

🔒 Below are the Rest of the Market Leaders (Upgrade to Premium to Unlock the Home Builders, Argentina Banks, & Recovery Plays)

Mining stocks

Context: These stocks are being re-rated. The market is realizing that AI needs Power (Coal) and Hardware (Strategic Minerals).

$BTU ( ▲ 3.01% ) – Swing trade

-

Context: Coal is making a comeback as "AI Power." With data centers demanding massive 24/7 baseload energy that renewables can't yet provide, coal plants are staying online longer.

-

The Setup: A clean Breakout followed by a textbook pullback to the 20-Day Moving Average and the breakout level. We also have a Gap Up showing institutional buying pressure.

BTU Daily

$UAMY ( ▲ 22.77% ) – Swing trade

-

Context: Antimony is critical for munitions (defense) and next-gen batteries. With supply chains tightening, UAMY is the domestic go-to player.

-

The Setup: The stock is pulling back to a rising 50-Day Moving Average.

-

Technical Note: When a stock rises above a falling 50MA, it almost always comes back to test it. We are at that test point now. Watch for the bounce.

UAMY Daily

$NB ( ▲ 21.75% ) – Swing trade

-

Context: NioCorp is developing the Elk Creek project (Niobium, Scandium, Titanium). These are light-weighting metals essential for EVs and aerospace.

-

The Setup: Similar to $UAMY—a technical pullback to support within a new uptrend.

NB Daily

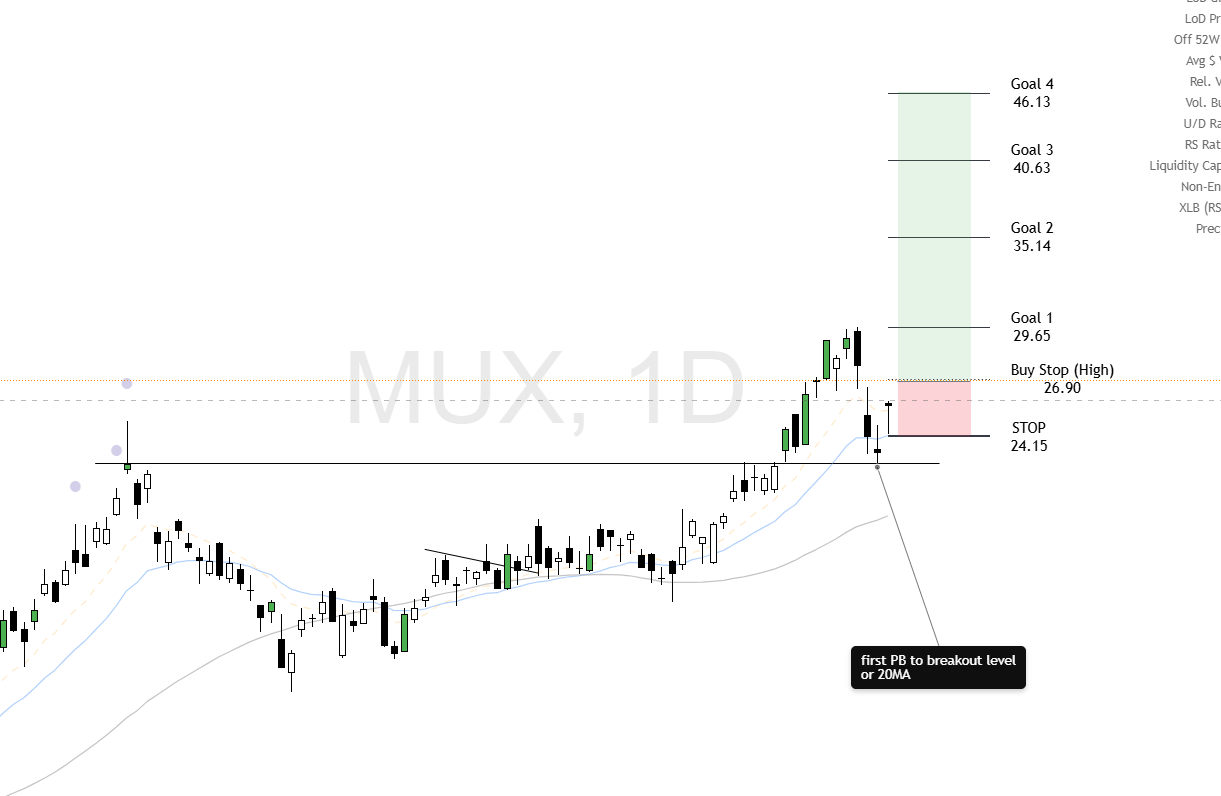

$MUX ( ▲ 9.34% ) – Swing trade

-

Context: A diversified producer of Gold, Silver, and Copper. They recently reported high-grade drill results and are consolidating their Nevada operations.

-

The Setup: Similar to the $BTU setup—a breakout followed by a "check back" to test the breakout level

MUX Daily

📊 Trading Framework Reminder

Remember: Every long-term investment alert can also be played as a swing trade.

Long-Term Investors (3-12 Month Holds)

-

Entry: Full position on breakout

-

Profit Taking: Sell 1/4 to 1/5 at Goal 1

-

Exit Signal: Close below 20-day EMA (your trend guide) or 50EMA

-

Why: Strong moves are hard to time at the top, but the 20EMA acts as a reliable trend filter

Swing Traders (2-6 Week Holds)

-

Entry: Full position on breakout

-

Profit Taking: Sell 1/3 at Goal 1

-

Final Exit: Remainder at Goal 2

💬 How Did We Do?

We’d love to hear your thoughts on this week’s alert!

Was it helpful? Did anything stand out to you? Your feedback helps us improve and keep delivering top-tier insights.

👉 If you're enjoying your premium membership, consider leaving us a quick review — it means a lot!

Regards,

Valentine