Core Investor Strategies

Perfect for busy professionals and retirement accounts: Six institutional-grade patterns designed for 2-6 month holds, requiring just 2-3 hours weekly to manage

A bullish continuation pattern resembling a teacup with a handle, signaling potential breakouts after consolidation periods.

Past Winner: NVDA - 200% in 4 months

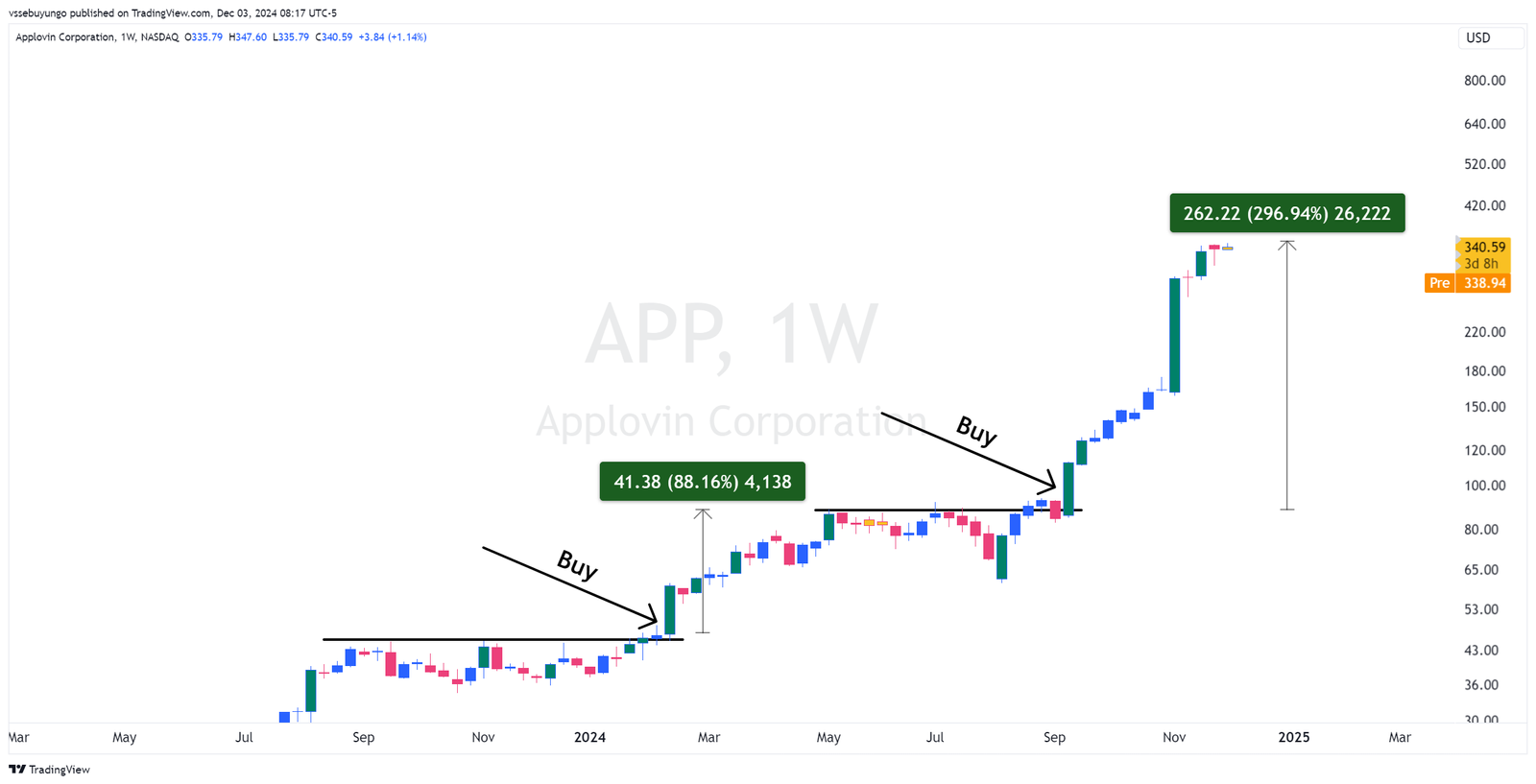

Sideways price action patterns including Flat Base (tight consolidation) and Box Base (rectangular consolidation).

Past Winner: VITL - 190% in 6 months

A reversal pattern forming a 'W' shape, indicating strong support levels and potential trend reversals.

Several past winners

A powerful reversal pattern featuring a lower low (head) between two higher lows (shoulders), signaling the potential end of a downtrend.

Past Winner: APP - 250% in 2 months

Volatility Contraction Pattern showing distinct contractions in price, typically leading to explosive moves. Adapted from Mark Minervini

SMCI - 200% in 3 months

A series of higher lows with orderly pullbacks, showing steady institutional accumulation.

Several past winners

Each strategy includes precise entry points, position sizing, and risk management rules.