:root {

–wt-primary-color: #030712;

–wt-text-on-primary-color: #F9FAFB;

–wt-secondary-color: #F9FAFB;

–wt-text-on-secondary-color: #030712;

–wt-tertiary-color: #FFFFFF;

–wt-text-on-tertiary-color: #222222;

–wt-background-color: #FFFFFF;

–wt-text-on-background-color: #030712;

–wt-subscribe-background-color: #FFFFFF;

–wt-text-on-subscribe-background-color: #030712;

–wt-header-font: “Lato”, ui-sans-serif, system-ui, -apple-system, BlinkMacSystemFont, “Segoe UI”, Roboto,”Helvetica Neue”, Arial, “Noto Sans”, sans-serif, “Apple Color Emoji”, “Segoe UI Emoji”, “Segoe UI Symbol”, “Noto Color Emoji”;

–wt-body-font: “Karla”, ui-sans-serif, system-ui, -apple-system, BlinkMacSystemFont, “Segoe UI”, Roboto, “Helvetica Neue”, Arial, “Noto Sans”, sans-serif, “Apple Color Emoji”, “Segoe UI Emoji”, “Segoe UI Symbol”, “Noto Color Emoji”;

–wt-button-font: “Karla”, ui-sans-serif, system-ui, -apple-system, BlinkMacSystemFont, “Segoe UI”, Roboto, “Helvetica Neue”, Arial, “Noto Sans”, sans-serif, “Apple Color Emoji”, “Segoe UI Emoji”, “Segoe UI Symbol”, “Noto Color Emoji”;

–wt-border-radius: 8px

}

.bg-wt-primary { background-color: var(–wt-primary-color); }

.text-wt-primary { color: var(–wt-primary-color); }

.border-wt-primary { border-color: var(–wt-primary-color); }

.bg-wt-text-on-primary { background-color: var(–wt-text-on-primary-color); }

.text-wt-text-on-primary { color: var(–wt-text-on-primary-color); }

.border-wt-text-on-primary { border-color: var(–wt-text-on-primary-color); }

.bg-wt-secondary { background-color: var(–wt-secondary-color); }

.text-wt-secondary { color: var(–wt-secondary-color); }

.border-wt-secondary { border-color: var(–wt-secondary-color); }

.bg-wt-text-on-secondary { background-color: var(–wt-text-on-secondary-color); }

.text-wt-text-on-secondary { color: var(–wt-text-on-secondary-color); }

.border-wt-text-on-secondary { border-color: var(–wt-text-on-secondary-color); }

.bg-wt-tertiary { background-color: var(–wt-tertiary-color); }

.text-wt-tertiary { color: var(–wt-tertiary-color); }

.border-wt-tertiary { border-color: var(–wt-tertiary-color); }

.bg-wt-text-on-tertiary { background-color: var(–wt-text-on-tertiary-color); }

.text-wt-text-on-tertiary { color: var(–wt-text-on-tertiary-color); }

.border-wt-text-on-tertiary { border-color: var(–wt-text-on-tertiary-color); }

.bg-wt-background { background-color: var(–wt-background-color); }

.text-wt-background { color: var(–wt-background-color); }

.border-wt-background { border-color: var(–wt-background-color); }

.bg-wt-text-on-background { background-color: var(–wt-text-on-background-color); }

.text-wt-text-on-background { color: var(–wt-text-on-background-color); }

.border-wt-text-on-background { border-color: var(–wt-text-on-background-color); }

.bg-wt-subscribe-background { background-color: var(–wt-subscribe-background-color); }

.text-wt-subscribe-background { color: var(–wt-subscribe-background-color); }

.border-wt-subscribe-background { border-color: var(–wt-subscribe-background-color); }

.bg-wt-text-on-subscribe-background { background-color: var(–wt-text-on-subscribe-background-color); }

.text-wt-text-on-subscribe-background { color: var(–wt-text-on-subscribe-background-color); }

.border-wt-text-on-subscribe-background { border-color: var(–wt-text-on-subscribe-background-color); }

.rounded-wt { border-radius: var(–wt-border-radius); }

.wt-header-font { font-family: var(–wt-header-font); }

.wt-body-font { font-family: var(–wt-body-font); }

.wt-button-font { font-family: var(–wt-button-font); }

input:focus { –tw-ring-color: transparent !important; }

li a { word-break: break-word; }

@media only screen and (max-width:667px) {

.mob-stack {

display: block !important;

width: 100% !important;

}

.mob-w-full {

width: 100% !important;

}

}

@font-face {

font-family: ‘Karla’;

font-style: normal;

font-weight: 400;

font-display: swap;

src: url(‘https://fonts.gstatic.com/s/karla/v31/qkBIXvYC6trAT55ZBi1ueQVIjQTD-JqaE0lK.woff2’) format(‘woff2’);

}

@font-face {

font-family: ‘Karla’;

font-style: italic;

font-weight: 400;

font-display: swap;

src: url(‘https://fonts.gstatic.com/s/karla/v31/qkBKXvYC6trAT7RQNNK2EG7SIwPWMNlCV3lIb7P1HgGQ4tc.woff2’) format(‘woff2’);

}

@font-face {

font-family: ‘Instrument Sans’;

font-style: normal;

font-weight: 400;

font-display: swap;

src: url(‘https://fonts.gstatic.com/s/instrumentsans/v1/pximypc9vsFDm051Uf6KVwgkfoSxQ0GsQv8ToedPibnr-yp2JGEJOH9npSTF-TfykywN2u7ZWwU.woff2’) format(‘woff2’);

}

@font-face {

font-family: ‘Instrument Sans’;

font-style: italic;

font-weight: 400;

font-display: swap;

src: url(‘https://fonts.gstatic.com/s/instrumentsans/v1/pxigypc9vsFDm051Uf6KVwgkfoSbSnNPooZAN0lInHGpCWNE27lgU-XJojENuu-2oy4H28zdQwQzNA.woff2’) format(‘woff2′);

}

.table-base, .table-c, .table-h { border: 1px solid #C0C0C0; }

.table-c { padding:5px; background-color:#FFFFFF; }

.table-c p { color: #2D2D2D; font-family:’Karla’,-apple-system,BlinkMacSystemFont,Roboto,sans-serif !important; overflow-wrap: break-word; }

.table-h { padding:5px; background-color:#F1F1F1; }

.table-h p { color: #2A2A2A; font-family:’Trebuchet MS’,’Lucida Grande’,Tahoma,sans-serif !important; overflow-wrap: break-word; }

font-size: .875rem;

line-height: 1.25rem;

vertical-align: middle;

justify-content: space-between;

display: block;

}

.bh__byline_social_wrapper {

display: flex;

margin-top: 0.5rem;

align-items: center;

}

.bh__byline_social_wrapper > * + * {

margin-left: 0.5rem;

}

@media (min-width: 768px) {

.bh__byline_wrapper {

display: flex;

}

.bh__byline_social_wrapper {

margin-top: 0rem;

}

}

Don’t Miss This Breakout

The Top 2 setups you need to watch now.

📰 In This Issue…

p span[style*=”font-size”] { line-height: 1.6; }

We are tracking a beast in the energy sector today. Historically, this specific setup triggers a 150% rally, and the signal just flashed again.

p span[style*=”font-size”] { line-height: 1.6; }

Inside this edition:

-

The Headliner: Why $GEV is the #1 stock to watch right now (and how to trade it).

-

The Logic: Using physics to predict the breakout.

-

🔒 Premium Only: We unlock the rest of the watchlist, including the "Amazon of Africa" ($JMIA) emerging from a massive base

p span[style*=”font-size”] { line-height: 1.6; }

Don't stick to the sidelines while the leaders run.

🏆 Top Setup of the Day

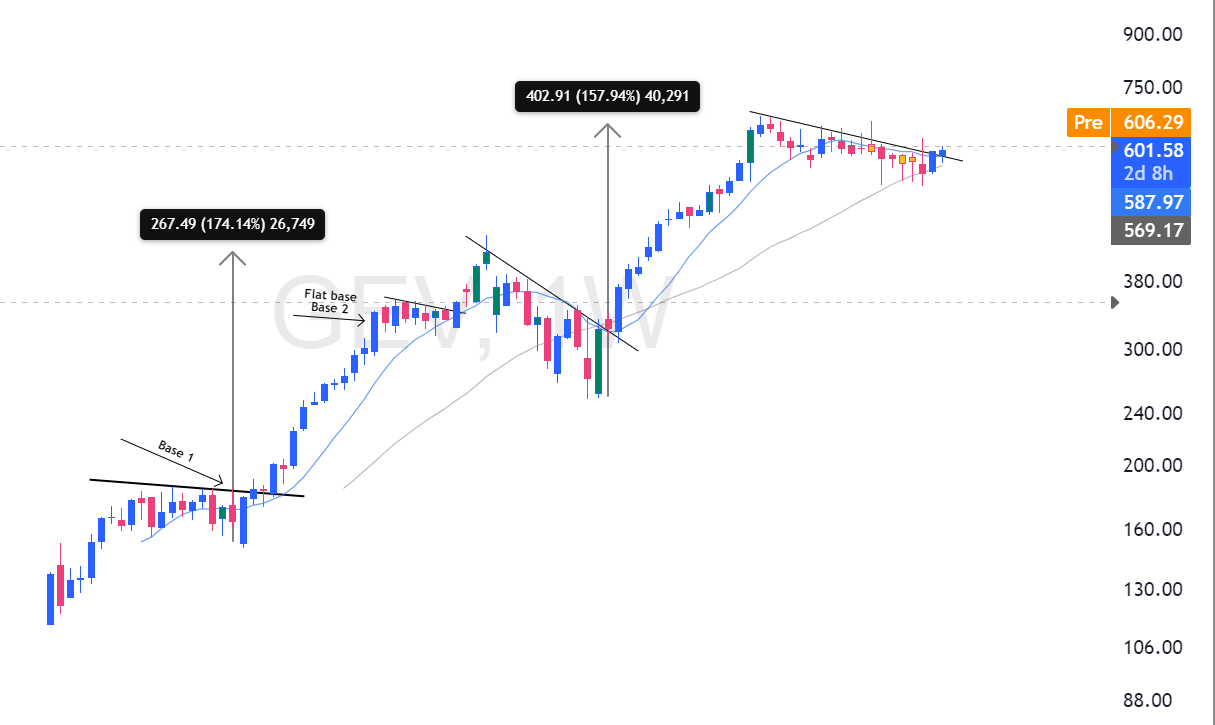

$GEV ( ▼ 4.61% ) – Long term trade (Same as last time)

-

The Context: A spin-off from General Electric, GEV is a global leader in the energy transition, focusing on power, wind, and electrification. They recently secured a massive wind contract with Taiwan Power and are aggressively expanding U.S. manufacturing to meet soaring grid demands.

-

The Setup: This stock is a beast. Historically, every pullback to the 30-week Moving Average has launched a ~150% rally. We are there again.

-

The Logic: The price action is incredibly tight. Volatility is contracting, and in physics as in markets, contraction leads to expansion (the breakout).

-

Profit Punch Tip: For those with higher risk tolerance, you can amplify this trade using $GEVX ( ▼ 9.47% ) (The 2x Leveraged ETF).

-

👉 Check the Weekly Chart first, then zoom in on the Daily.

p span[style*=”font-size”] { line-height: 1.6; }

👉 Check out its weekly chart and then check out the daily chart.

GEV Weekly Chart

p span[style*=”font-size”] { line-height: 1.6; }

GEV has gapped up 10% today morning, this is already 12% profit from when I originally announced this.

GEV Daily Chart

🔒 Below are the Rest of the Market Leaders

Cyclical Sector

$JMIA ( ▼ 4.0% ) – Swing trade

p span[style*=”font-size”] { line-height: 1.6; }

The Context: Often called the "Amazon of Africa," Jumia ($JMIA) operates the leading e-commerce and logistics platform across the African continent. After streamlining operations and improving unit economics, the stock is reacting violently to renewed growth expectations.

p span[style*=”font-size”] { line-height: 1.6; }

The Setup: We are seeing a classic Cup and Handle pattern complete with a very buyable gap up. The volume is confirming the move.

JMIA Daily Chart

📊 Trading Framework Reminder

p span[style*=”font-size”] { line-height: 1.6; }

Remember: Every long-term investment alert can also be played as a swing trade.

Long-Term Investors (3-12 Month Holds)

-

Entry: Full position on breakout

-

Profit Taking: Sell 1/4 to 1/5 at Goal 1

-

Exit Signal: Close below 20-day EMA (your trend guide) or 50EMA

-

Why: Strong moves are hard to time at the top, but the 20EMA acts as a reliable trend filter

Swing Traders (2-6 Week Holds)

-

Entry: Full position on breakout

-

Profit Taking: Sell 1/3 at Goal 1

-

Final Exit: Remainder at Goal 2

💬 How Did We Do?

p span[style*=”font-size”] { line-height: 1.6; }

We’d love to hear your thoughts on this week’s alert!

Was it helpful? Did anything stand out to you? Your feedback helps us improve and keep delivering top-tier insights.

p span[style*=”font-size”] { line-height: 1.6; }

👉 If you're enjoying your premium membership, consider leaving us a quick review — it means a lot!

p span[style*=”font-size”] { line-height: 1.6; }

Regards,

p span[style*=”font-size”] { line-height: 1.6; }

Valentine