Don’t Miss This Argentina Signal

400% Gains in 12 Months?

📰 In This Issue…

The US market is acting wishy-washy, so I’m taking my capital where the real momentum is.

While everyone is distracted by choppy action in the S&P 500, a massive "Cluster Buy" signal has just triggered in South America. The last time we saw this specific technical setup, the leading names rallied 400%.

Inside this edition:

-

The Headliner: The "Argentina 4-Pack"—why banking stocks are flashing a rare bullish crossover.

-

The Logic: How to trade the "Cluster" effect (and why stocks move in packs).

-

🔒 Premium Only: We unlock the Commodities Supercycle (Aluminum, Lithium, Coal) and the return of the "Amazon of Africa."

Stop chasing noise. Start chasing strength.

🏆 Top Setup of the Day

The Signal: Argentinian banking stocks have just confirmed a 10-Week / 30-Week Moving Average Crossover. This is a classic long-term bullish signal. The sector ETF ($ARGT ( ▼ 0.06% ) ) is hovering near all-time highs, confirming the strength of the trend.

The Context: Argentina is in the middle of a massive economic "normalization." With inflation cooling and fiscal discipline returning, the banking sector is the primary vehicle for institutional money flooding back into the country.

The Logic: The formula for a super-performance trade is simple:

-

Market: Find the strongest primary market (Right now? It’s Argentina, not the US).

-

Sector: Find the strongest industry (Banks).

-

Stock: Find the leaders with the best technicals.

Argentina Banks 2024-2025

The "Cluster" Proof: If you ever needed proof that stocks move in herds, this is it. We have four different banks showing nearly identical patterns. When they move together, the trend is real.

$SUPV ( ▲ 0.34% ) – Long term trade

The Context: Supervielle is a banking group that serves the heart of Argentina's SME and consumer sectors. It is highly sensitive to the country's recovery narrative, making it a high-beta play on the nation's success.

The Setup: I am treating this as a "position trade." I’m looking to buy, sit on my hands for 6–24 months, and collect a massive check at the end.

History: The last time this 10/30 crossover hit, $SUPV rallied 600%.

SUPV Weekly Chart – SUPV Had a 600% move after this signal in 2024-2025

SUPV Daily

🔒 Below are the Rest of the Market Leaders (Upgrade to Premium to Unlock the Commodities & Swing Trade Alerts)

Argentina Stocks Continues

Context: These three stocks mirror the $SUPV ( ▲ 0.34% ) setup. Pick ONE of the four. Do not buy all of them; if the sector fails, they all fail. Split your risk, don't duplicate it.

$BMA ( ▲ 0.41% ) – Long term trade

Context: One of the most solid private banks in Argentina, Banco Macro focuses on low-to-mid-income individuals. It historically pays dividends and has a rock-solid balance sheet compared to its peers.

BMA Daily Chart

$BBAR ( ▼ 0.28% ) – Long term trade

Context: As a subsidiary of the global giant BBVA, this is the oldest private bank in the country. It offers a blend of local explosive potential with international backing.

BBAR Daily

$GGAL ( ▼ 0.22% ) – Long term trade

Context: The largest private sector commercial bank in Argentina. GGAL is often the "go-to" stock for foreign institutions looking for liquidity in the Argentine market.

GGAL Daily

Metals and Commodities Stocks

Context: We are seeing a "silent bull market" in physical assets. While tech falters, Aluminum, Coal, and Lithium are breaking out.

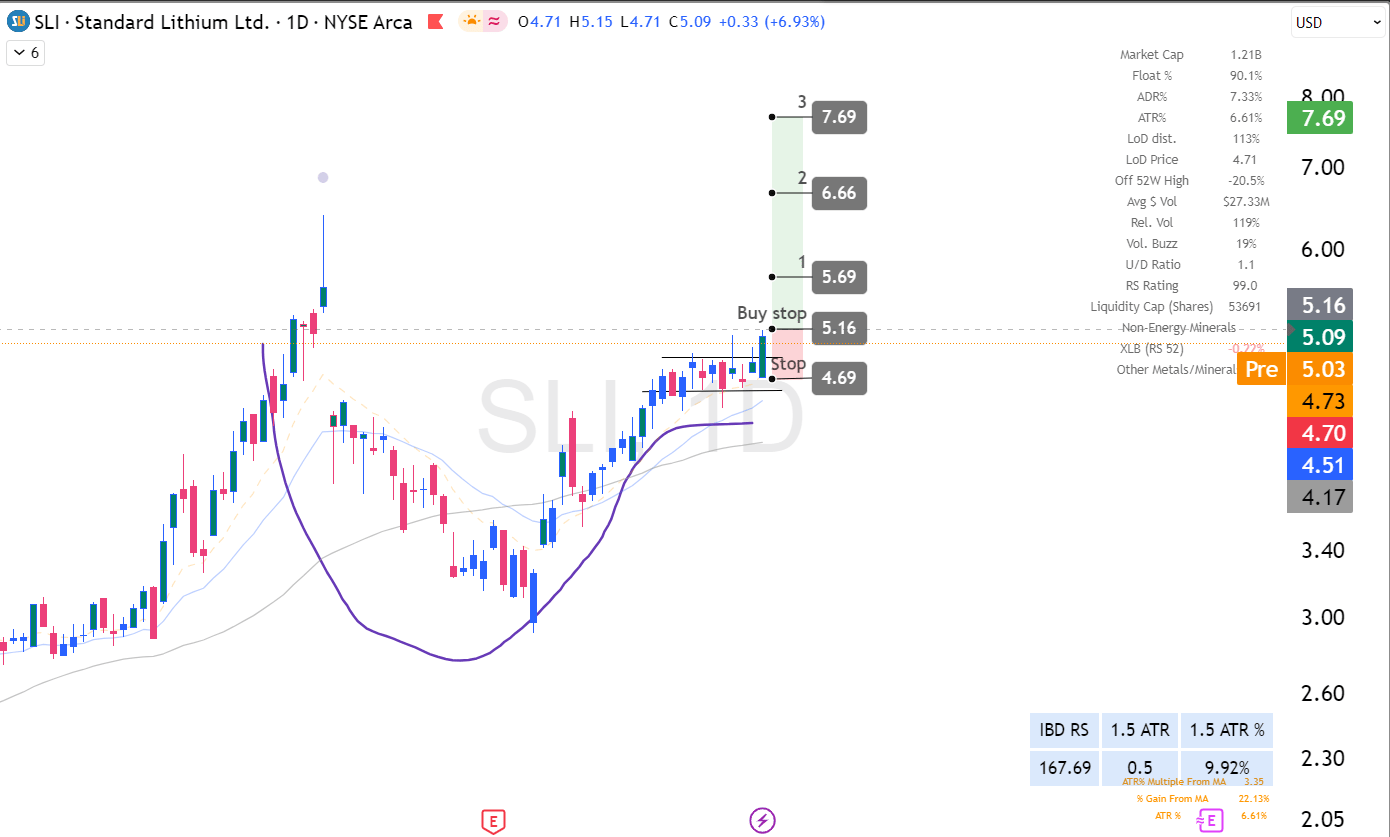

$SLI ( ▼ 1.54% ) – Swing trade

-

Context: A key player in the US battery supply chain, SLI uses modern Direct Lithium Extraction (DLE) technology in Arkansas. The stock popped recently after China cancelled several mining licenses, tightening global supply.

-

The Setup: A clean Cup and Handle with a tight "cheat" entry.

$CENX ( ▼ 1.29% ) – Swing trade

-

Context: The largest primary aluminum producer in the US. With China capping its aluminum output to meet emissions goals, global supply is constrained, putting a floor under prices.

-

The Setup: Another textbook Cup and Handle.

CENX Daily

$BTU ( ▼ 0.44% ) – Swing trade

-

Context: A leading coal producer pivoting toward high-demand Asian markets. Despite the "green" narrative, global demand for thermal and metallurgical coal remains robust, driving cash flow.

-

The Setup: Rebounding off the 50-day SMA with a Cup and Handle formation.

BTU Daily

📊 Cyclical Sector

$JMIA ( ▲ 2.21% ) – Swing trade

-

Context: Often called the "Amazon of Africa," Jumia has been aggressively cutting costs to reach profitability. The stock is volatile but is currently reacting to a strong "turnaround" narrative.

-

The Setup: A nice Cup and Handle setup.

-

⚠️ Warning: I am wary here because the primary market (US Stocks) is untrustworthy right now. Keep stops tight.

JMIA Daily

📊 Trading Framework Reminder

Remember: Every long-term investment alert can also be played as a swing trade.

Long-Term Investors (3-12 Month Holds)

-

Entry: Full position on breakout

-

Profit Taking: Sell 1/4 to 1/5 at Goal 1

-

Exit Signal: Close below 20-day EMA (your trend guide) or 50EMA

-

Why: Strong moves are hard to time at the top, but the 20EMA acts as a reliable trend filter

Swing Traders (2-6 Week Holds)

-

Entry: Full position on breakout

-

Profit Taking: Sell 1/3 at Goal 1

-

Final Exit: Remainder at Goal 2

💬 How Did We Do?

We’d love to hear your thoughts on this week’s alert!

Was it helpful? Did anything stand out to you? Your feedback helps us improve and keep delivering top-tier insights.

👉 If you're enjoying your premium membership, consider leaving us a quick review — it means a lot!

Regards,

Valentine