Don't Waste a Good Crisis

5 Strong Stocks that held up while the market tanked.

📰 In This Issue…

Last week, the market flushed out the weak hands in Tech. Good. While the "AI Tourists" were panic selling, the "Real Economy" stocks—Homebuilders and Infrastructure—were quietly thriving.

We are seeing a massive rotation into the companies that build the future (Data Centers, Power Grids, Homes) rather than just the ones that code it.

Inside this edition:

-

The Headliner: $PRIM ( ▲ 8.5% ) (Primoris)—The infrastructure giant breaking out of a 16-week base.

-

The AI Infrastructure Play: Why $APLD ( ▲ 25.52% ) and $WULF ( ▲ 19.88% ) are the "second chance" entries you've been waiting for.

-

🔒 Premium Only: The "Solar Reversal" ( $SEDG ( ▲ 7.93% ) , $NXT ( ▲ 6.06% ) ) and the massive "Construction Boom" basket ( $EME ( ▲ 6.5% ) , $CRS ( ▲ 4.72% ) ).

The flush is done. The builders are running.

🏆 Top Setup of the Day

$PRIM ( ▲ 8.5% ) – Long term trade

The Context: Primoris is a massive infrastructure contractor specializing in power, pipelines, and broadband. Crucially, they are a key builder of Data Centers and renewable energy projects. As AI demands more power and physical infrastructure, Primoris gets the contract.

The Setup:

-

The Pattern: A perfect 16-Week Base breakout.

-

The Entry: The stock broke out and is now testing the breakout level (a classic "check back").

-

Confirmation: We see a strong bounce off the 20-Day Moving Average right after the breakout. This is "Tennis Ball" action—hard down, fast up.

PRIM Daily

🔒 Below are the Rest of the Market Leaders (Upgrade to Premium to Unlock the Home Builders, Argentina Banks, & Recovery Plays)

Data Processing stocks

$APLD ( ▲ 25.52% ) – Long term trade

-

Context: A next-gen data center provider designed for High-Performance Computing (HPC). They recently signed massive leases with hyperscalers.

-

The Setup: Retesting support after a false breakout. Strategy: Build a starter position here, but wait for a confirmed move back above the highs to go full size.

APLD Daily

$WULF ( ▲ 19.88% ) – Long term trade

-

Context: The "Zero-Carbon" miner pivoting to AI. They use nuclear and hydro power, making them the greenest option for ESG-conscious tech giants.

-

The Setup: Held up incredibly well during last week's flush. Relative strength is a leading indicator.

WULF Daily

Tech stocks

$PLAB ( ▲ 8.29% ) – Swing trade

-

Context: The world's leader in photomasks (the "stencils" used to print chips). This is a critical supply chain play that acts as a gatekeeper for the entire semi industry.

-

The Setup: Showed massive relative strength by holding up while the sector tanked.

PLAB Daily

$ALAB ( ▲ 18.93% ) – Long term trade

-

Context: Astera makes the "connectivity" chips that allow massive clusters of GPUs to talk to each other.

-

The Setup: A Triple Bottom recovery on strong volume.

-

⚠️ Earnings Alert: Earnings are in 2 days. Stocks showing volume before earnings often know something. Watch, but be careful holding through the event.

ALAB Daily

$VRT ( ▲ 10.03% ) – Long term trade

-

Context: The King of Cooling. Vertiv provides the thermal management needed to keep Nvidia's hottest chips from melting.

-

The Setup: Earnings this week. A breakout here could trigger a multi-week run.

VRT Daily

SOLAR Stocks

Solar stocks have been on a reversal this year, this could lead to significant gains in the future. Many solar stocks like ENPH and NXT jumped on earnings

$SEDG ( ▲ 7.93% ) – Long term trade (Turn around stock)

-

Context: A fallen angel. The stock crashed from $315 to $10, but is now transitioning from Stage 4 (Capitulation) to Stage 2 (Accumulation).

-

The Setup: Bottom fishing with defined risk.

SEDG Daily

$NXT ( ▲ 6.06% ) – Swing trade

-

Context: The profitable leader in solar. They make the mechanical trackers that move panels to follow the sun.

-

The Setup: Breakout followed by a clean retest.

NXT Daily

Cyclical Stocks

$RCL ( ▲ 6.72% ) – Long term trade

-

Context: The consumer is still spending on experiences. RCL is seeing record bookings.

-

The Setup: "Mid Cheat" entry after a strong earnings gap up.

RCL Daily

Industrial Stocks

$CRS ( ▲ 4.72% ) – Long term trade

-

Context: They make ultra-strong specialty alloys for aerospace (jet engines) and medical devices. Defense spending is a massive tailwind.

-

The Setup: Breakout from a Box Base after 3 months of tight consolidation.

CRS

$AMRZ ( ▲ 5.05% ) – Long term trade

-

Context: The newly listed North American building materials giant (spinoff from Holcim). They are the #1 roofing and cement player in the region.

-

The Setup: IPO Breakout. New merchandise often leads new bull runs.

AMRZ Daily

$EME ( ▲ 6.5% ) – Long term trade

-

Context: A Fortune 500 leader in mechanical and electrical construction. They build the guts of the factories and hospitals.

-

The Setup: A textbook Cup and Handle.

EME D

$PSIX ( ▲ 19.16% ) – Swing trade

-

Context: They make industrial engines that run on alternative fuels.

-

The Setup: Testing the 50-Day Moving Average right after crossing it (the "Golden Cross" retest)

PSIX Daily

Finance Stocks

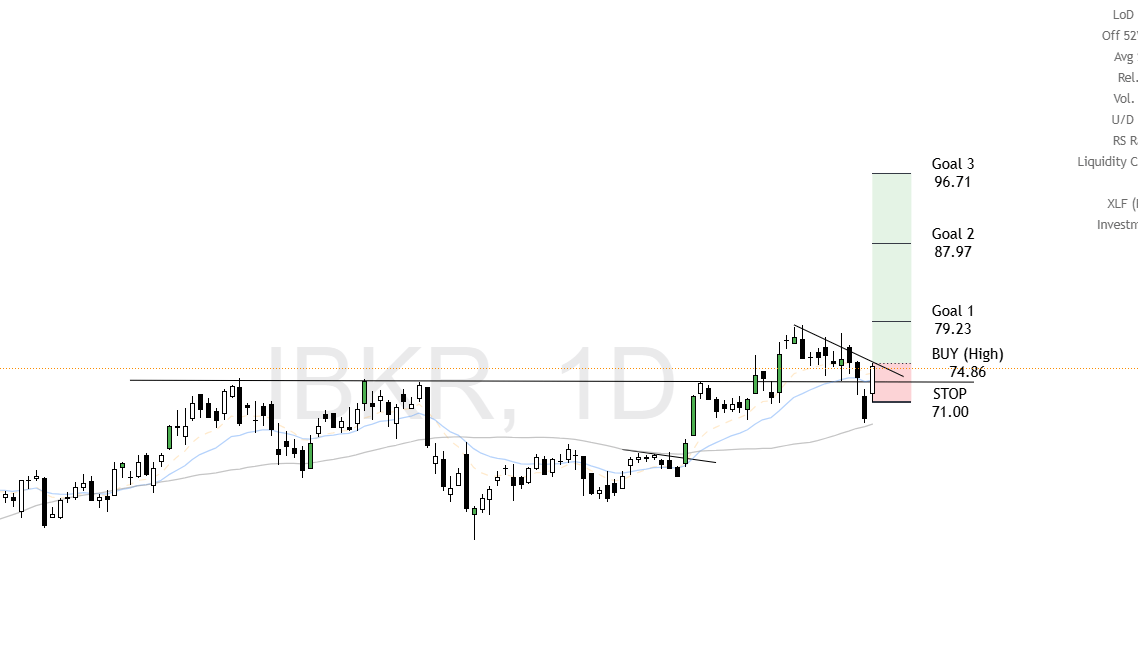

$IBKR ( ▲ 7.34% ) – Long term trade

-

Context: The "Smart Money" brokerage. As volatility increases, their trading volumes (and commissions) explode.

-

The Setup: False breakout retest. Like $APLD, build slowly until the trend confirms.

IBKR Daily

Mining stocks

Context: These stocks are being re-rated. The market is realizing that AI needs Power (Coal) and Hardware (Strategic Minerals).

$BTU ( ▲ 7.83% ) – Swing trade

-

Context: Coal is making a comeback as "AI Power." With data centers demanding massive 24/7 baseload energy that renewables can't yet provide, coal plants are staying online longer.

-

The Setup: A clean Breakout followed by a textbook pullback to the 20-Day Moving Average and the breakout level. We also have a Gap Up showing institutional buying pressure.

BTU Daily

$UAMY ( ▲ 15.26% ) – Swing trade

-

Context: Antimony is critical for munitions (defense) and next-gen batteries. With supply chains tightening, UAMY is the domestic go-to player.

-

The Setup: The stock is pulling back to a rising 50-Day Moving Average.

-

Technical Note: When a stock rises above a falling 50MA, it almost always comes back to test it. We are at that test point now. Watch for the bounce.

UAMY Daily

$MUX ( ▲ 8.79% ) – Swing trade

-

Context: A diversified producer of Gold, Silver, and Copper. They recently reported high-grade drill results and are consolidating their Nevada operations.

-

The Setup: Similar to the $BTU setup—a breakout followed by a "check back" to test the breakout level

MUX

China Stocks

$GDS ( ▲ 8.88% ) – Long term

The "Equinix of China"—building high-performance data centers.

GDS

$KC ( ▲ 5.68% ) – Long term

The AI Cloud play for the Chinese market.

KC Daily

$SY ( ▲ 13.13% ) – Swing trade

The "Medical Aesthetics" platform. A pure consumer recovery play.

SY Daily

📊 Trading Framework Reminder

Remember: Every long-term investment alert can also be played as a swing trade.

Long-Term Investors (3-12 Month Holds)

-

Entry: Full position on breakout

-

Profit Taking: Sell 1/4 to 1/5 at Goal 1

-

Exit Signal: Close below 20-day EMA (your trend guide) or 50EMA

-

Why: Strong moves are hard to time at the top, but the 20EMA acts as a reliable trend filter

Swing Traders (2-6 Week Holds)

-

Entry: Full position on breakout

-

Profit Taking: Sell 1/3 at Goal 1

-

Final Exit: Remainder at Goal 2

💬 How Did We Do?

We’d love to hear your thoughts on this week’s alert!

Was it helpful? Did anything stand out to you? Your feedback helps us improve and keep delivering top-tier insights.

👉 If you're enjoying your premium membership, consider leaving us a quick review — it means a lot!

Regards,

Valentine