Rare Earths & Lithium: The "Hard Asset" Rally

2 Stocks breaking out of massive bases.

📰 In This Issue…

The market is rewarding "Real Assets" right now. While software stocks chop around, the companies that dig, refine, and secure America's supply chain are launching.

We are focusing on two "National Security" trades today: Rare Earths and Lithium. These stocks were beaten down last year, but they spent that time building massive bases. Now, the technicals are confirming a major reversal.

Inside this edition:

-

The Headliner: $MP ( ▲ 1.77% ) Materials—The only scaled rare earth mine in the West is breaking out.

-

The Leveraged Play: How to use the MPG (2x Long MP) ETF to supercharge your gains.

-

🔒 Premium Only: The "Smackover" Lithium play ( $SLI ( ▲ 9.28% ) ) and the rest of the Commodity Recovery basket.

The base is built. The breakout is here.

🏆 Top Setup of the Day

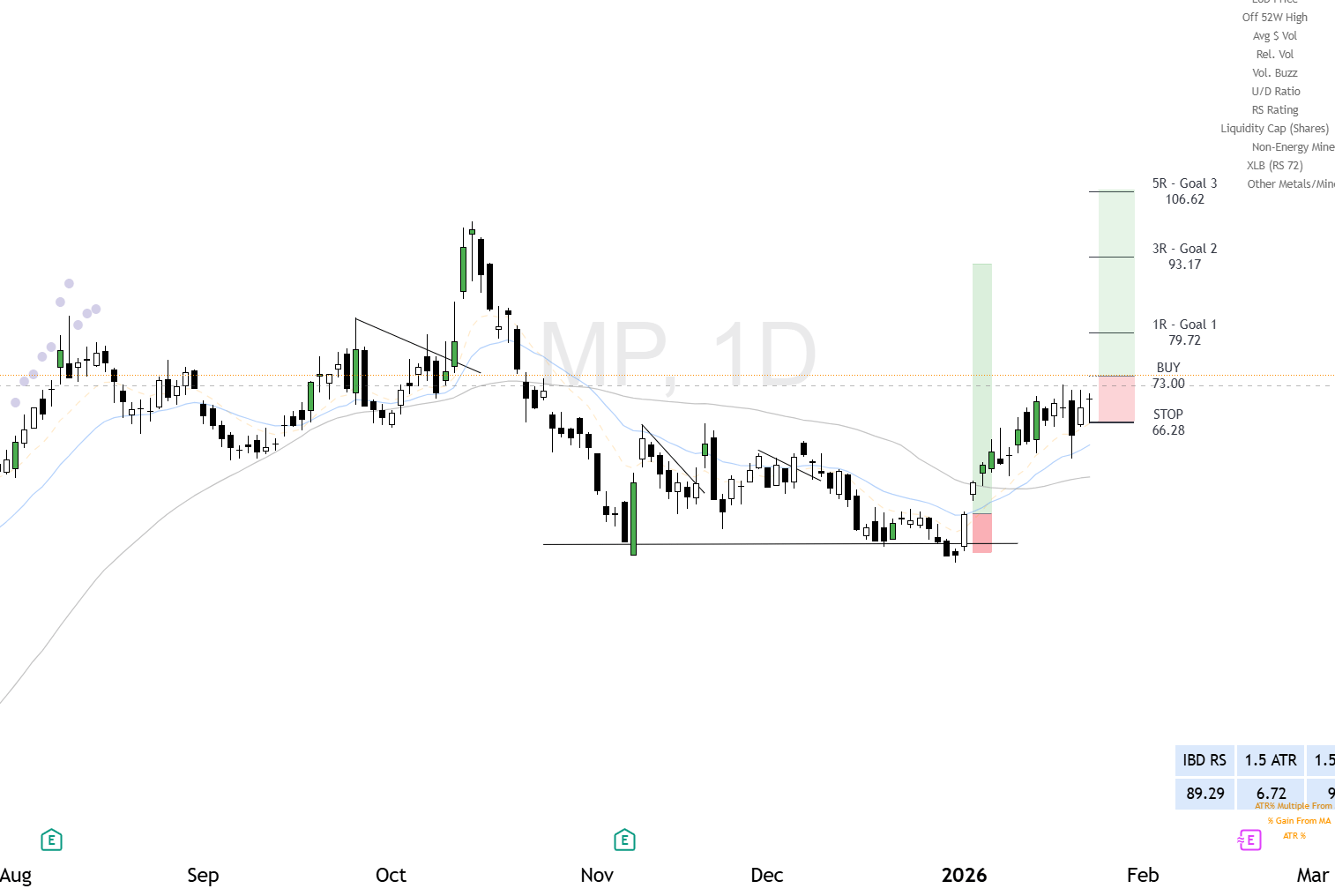

$MP ( ▲ 1.77% ) (MP Materials) – Long Term Trade

The Context: MP Materials owns Mountain Pass in California—the only scaled rare earth mining and processing site in the Western Hemisphere.

-

Why it matters: They are the "Anti-China" trade. With the Department of Defense funding their "mine-to-magnet" supply chain and a massive deal with Apple, MP is a critical national asset.

The Setup: This is a textbook long-term reversal.

-

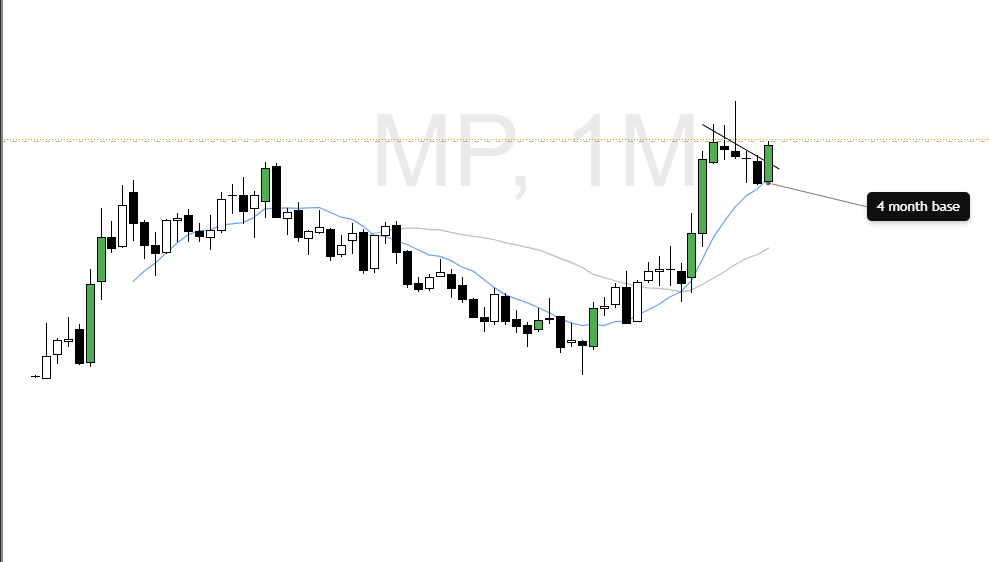

The Pattern: A solid 4-month base that has shaped up into a classic Cup and Handle.

-

The Signal: We saw a "Shakeout" in the base (where weak hands were flushed), and now the stock is jumping out of a "Mid Cheat" (a low-risk entry point halfway up the right side).

-

Aggressive Option: For those wanting leveraged access, you can use $MPG ( ▲ 3.57% ) (Leverage Shares 2x Long MP Daily ETF). Warning: This is high volatility—size accordingly.

MP Monthly

MP Daily

🔒 Below are the Rest of the Market Leaders (Upgrade to Premium to Unlock the Home Builders, Argentina Banks, & Recovery Plays)

🔋 Commodity Plays (Continued)

Context: These stocks were beaten down last year but are now forming massive bases. The risk/reward here is asymmetric.

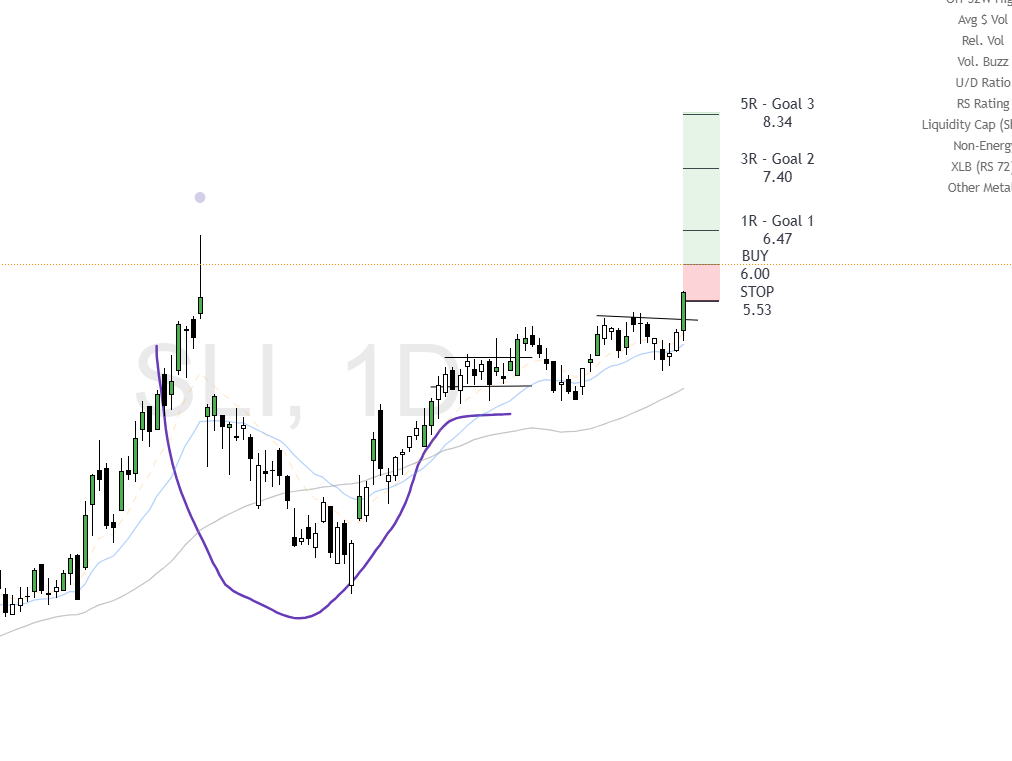

$SLI ( ▲ 9.28% ) SLI (Standard Lithium) – Long Term Trade

-

Context: Standard Lithium is leading "America's Lithium Gold Rush" in Arkansas (the Smackover Formation). Using Direct Lithium Extraction (DLE) technology, they are unlocking one of the fastest lithium projects in the West.

-

The Setup: Lithium stocks are showing strength across the board. $SLI just printed a Buyable Gap Up out of a Cup and Handle.

SLI Daily

📊 Trading Framework Reminder

Remember: Every long-term investment alert can also be played as a swing trade.

Long-Term Investors (3-12 Month Holds)

-

Entry: Full position on breakout

-

Profit Taking: Sell 1/4 to 1/5 at Goal 1

-

Exit Signal: Close below 20-day EMA (your trend guide) or 50EMA

-

Why: Strong moves are hard to time at the top, but the 20EMA acts as a reliable trend filter

Swing Traders (2-6 Week Holds)

-

Entry: Full position on breakout

-

Profit Taking: Sell 1/3 at Goal 1

-

Final Exit: Remainder at Goal 2

💬 How Did We Do?

We’d love to hear your thoughts on this week’s alert!

Was it helpful? Did anything stand out to you? Your feedback helps us improve and keep delivering top-tier insights.

👉 If you're enjoying your premium membership, consider leaving us a quick review — it means a lot!

Regards,

Valentine