Don’t Miss This Breakout

Why we are buying China Tech & Strategic Metals.

📰 In This Issue…

The US market is acting wishy-washy, so I’m focusing where the real heat is: China Tech and Strategic Metals.

While the S&P 500 chops around, Chinese stocks are quietly heating up, and the "Hard Asset" trade is back in play. We already banked "vacation money" on $BIDU ( ▲ 0.15% ) and $BABA ( ▲ 5.05% ) —now it’s time for the next leg up.

Inside this edition:

-

The Headliner: $KC ( ▲ 0.67% ) (Kingsoft Cloud)—The AI Cloud play that moved 600% last year is waking up again.

-

The Sector: Why Data Centers ( $GDS ( ▲ 3.08% ) , $VNET ( ▲ 2.87% ) ) are the "Pick and Shovel" trade for China's AI boom.

-

🔒 Premium Only: The Critical Minerals basket ( $LAC ( ▲ 8.11% ) , $NB ( ▲ 13.4% ) , $TMC ( ▲ 1.84% ) ) and the return of Clean Tech.

Stop fighting the chop. Follow the momentum.

🏆 Top Setup of the Day

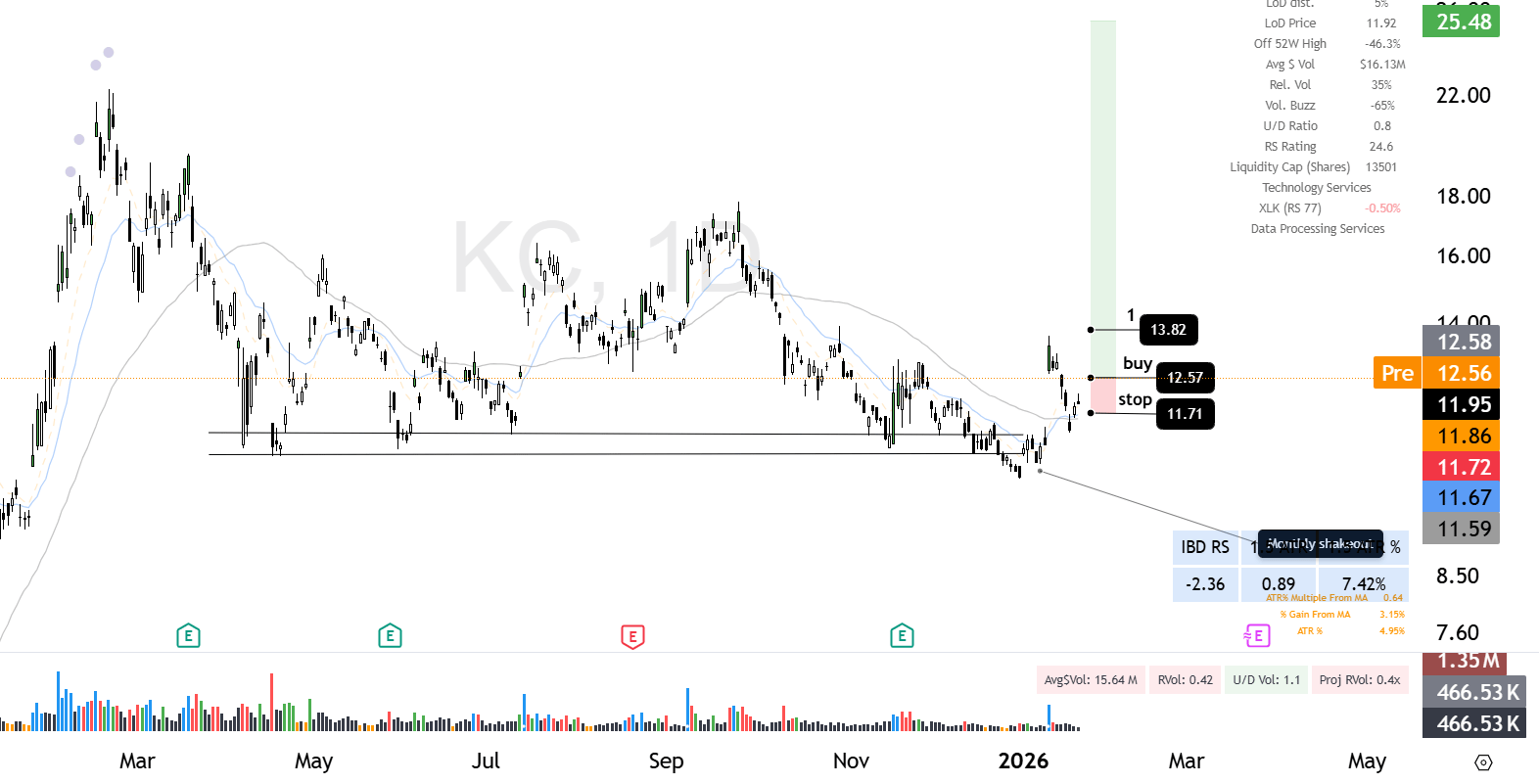

$KC ( ▲ 0.67% ) – Long term trade

The Context: Kingsoft Cloud is a leading independent cloud provider in China, heavily backed by Xiaomi. With China aggressively building out its own AI infrastructure to compete with the West, demand for independent cloud compute is exploding.

-

The Stat: AI revenue has been seeing triple-digit growth.

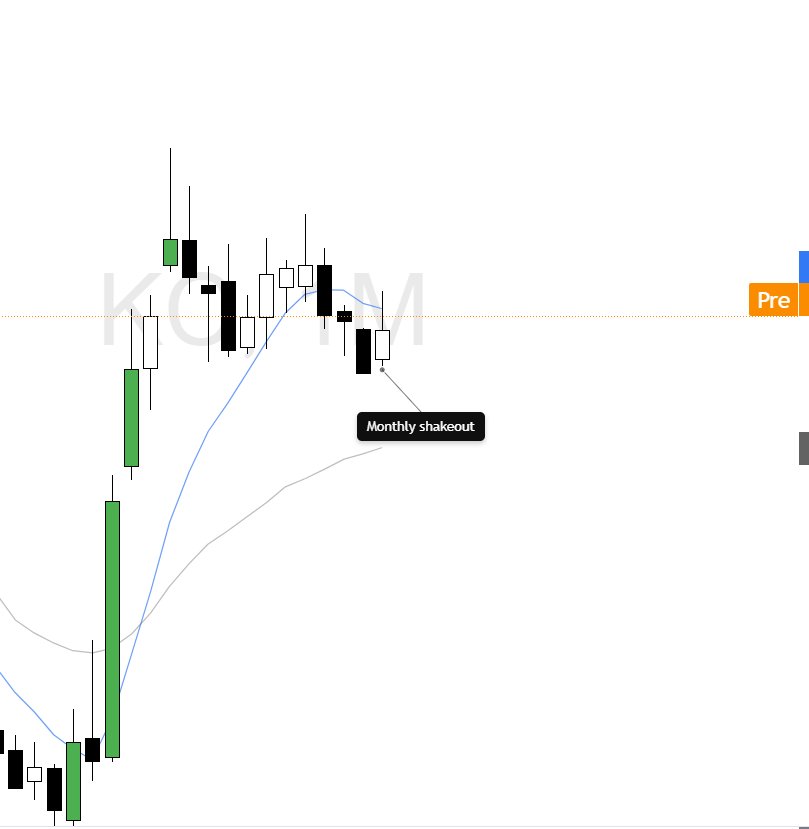

The Setup: Can it do it again? $KC ( ▲ 0.67% ) pulled a 600% move in 2024. Now, it has just completed a Monthly Shakeout (a false breakdown that traps bears). This is often the precursor to a massive sustained rally.

-

Sector Strength: Watch $GDS ( ▲ 3.08% ) and $VNET ( ▲ 2.87% ) (Data Centers) moving in sympathy. They are building the physical vaults where this AI data lives.

KC Monthly

KC Daily

🎁 Bonus Trade

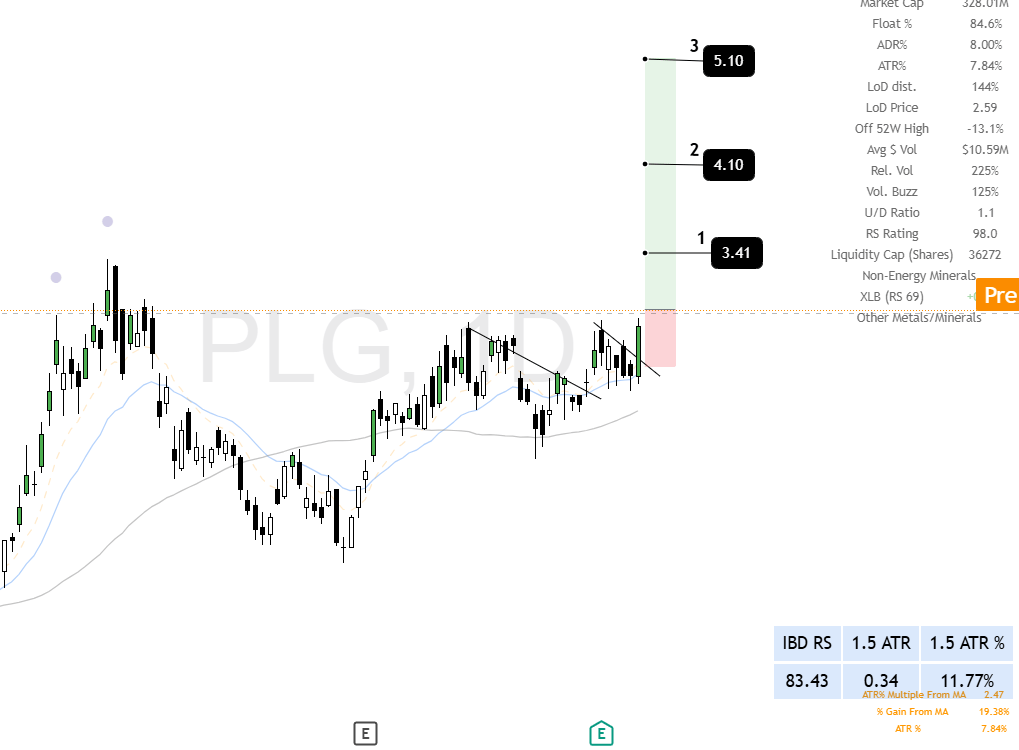

$PLG ( ▲ 10.61% ) – Swing trade

The Context: $PLG ( ▲ 10.61% ) operates the Waterberg Project in South Africa, a massive deposit of palladium and platinum. These metals are critical not just for catalytic converters, but increasingly for next-gen battery technologies (Lion Battery partnership).

The Setup: A classic Cup and Handle pattern with a clean breakout on the Monthly Chart.

-

Why it matters: Monthly breakouts are powerful signals for long-term trend reversals.

PLG Daily

🔒 Below are the Rest of the Market Leaders

Metal stocks Continues

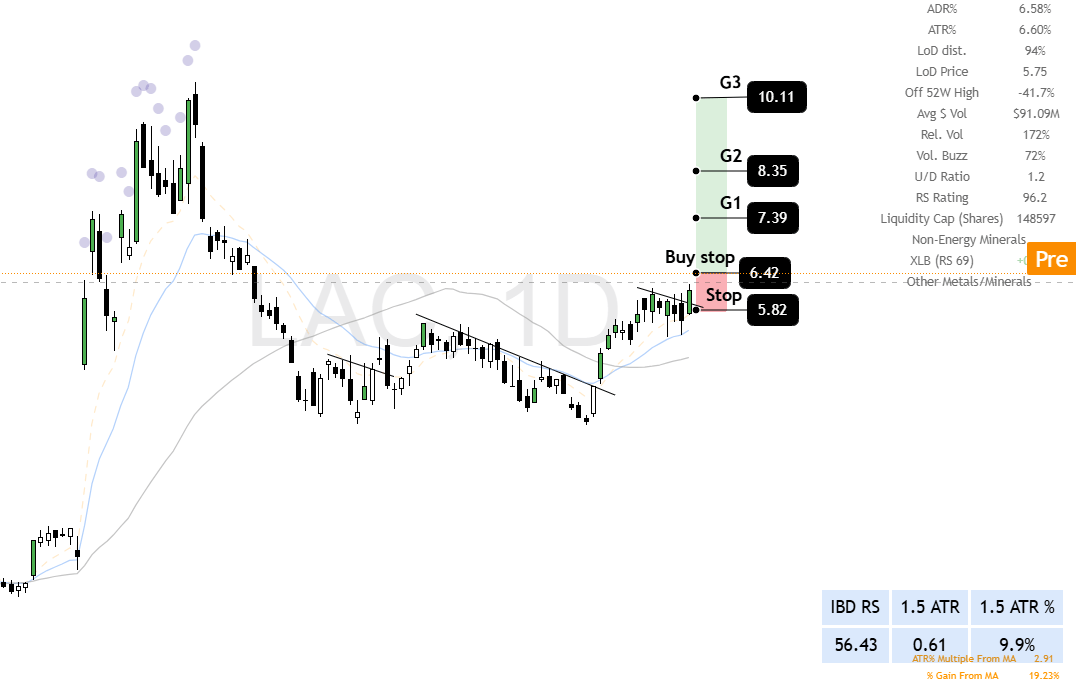

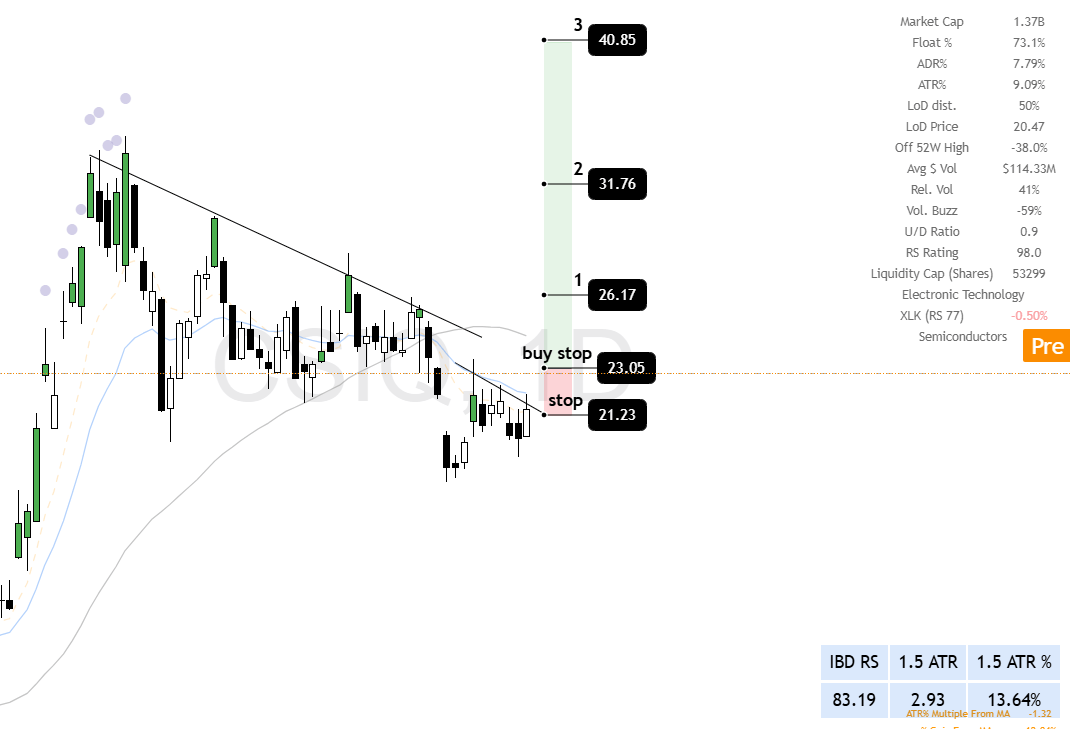

$LAC ( ▲ 8.11% ) – Swing trade

-

Context: The owner of Thacker Pass in Nevada, the largest known lithium resource in the US. With the Department of Energy loan secured and construction moving, this is a "National Security" trade.

-

The Setup: Lithium stocks are gapping up today (see $SGML ( ▼ 0.08% ) ). $LAC ( ▲ 8.11% ) is joining the party.

LAC Daily

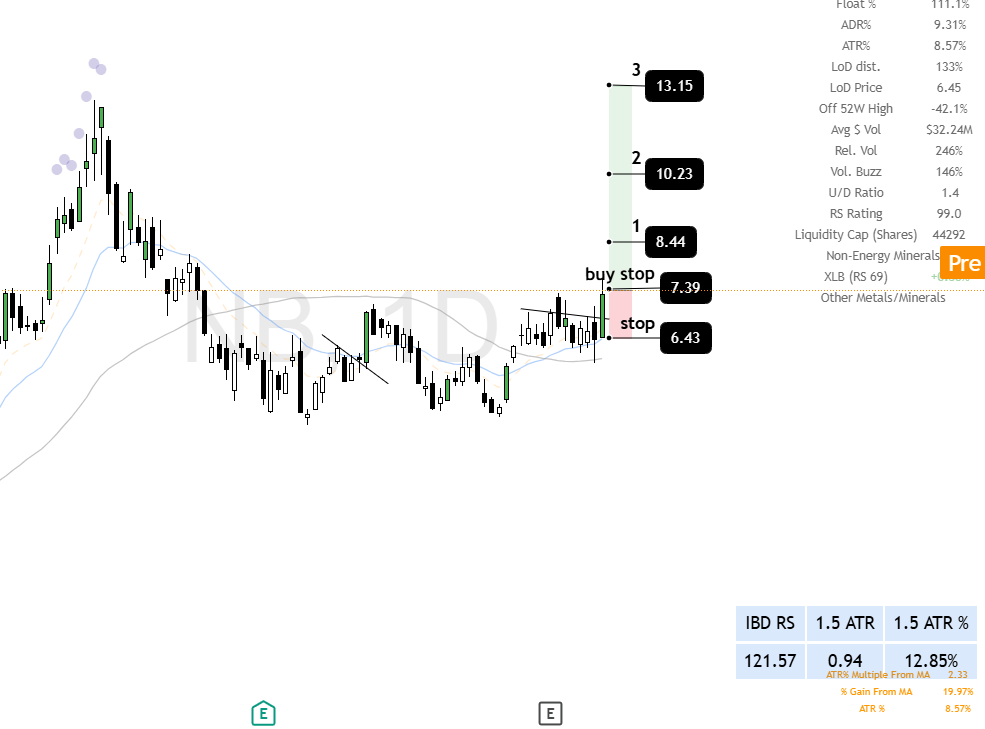

$NB ( ▲ 13.4% ) – Swing trade

Context: Developing the Elk Creek project in Nebraska. They mine Niobium, Scandium, and Titanium—critical metals used in fighter jets and lightweight EV frames. This is a pure defense/industrial play.

NB

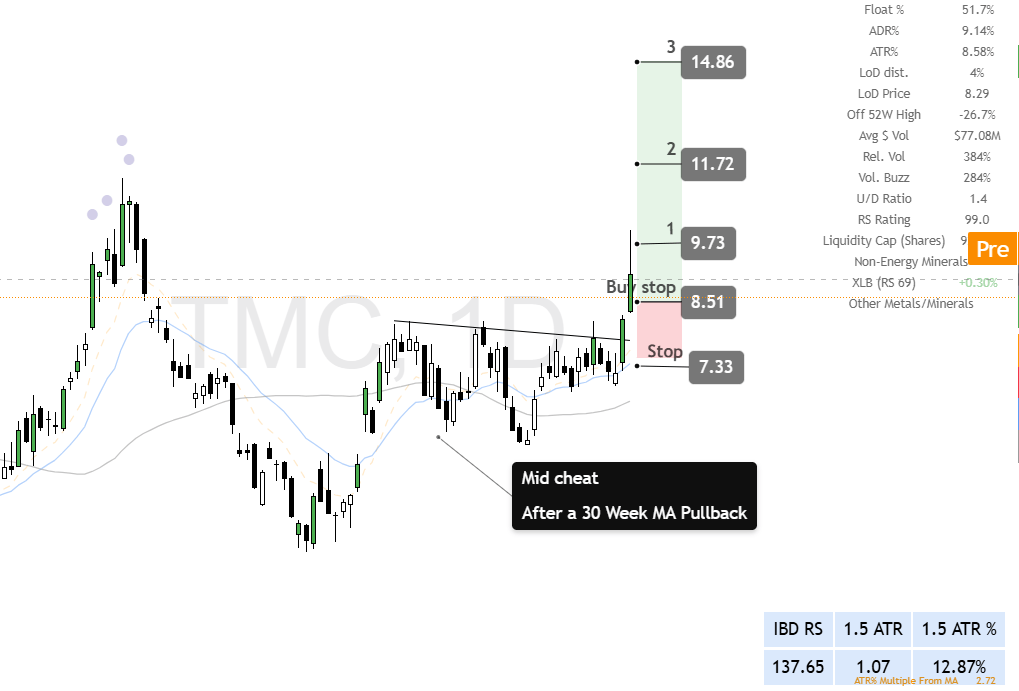

$TMC ( ▲ 1.84% ) – Swing trade

-

Context: A controversial but high-potential play on Deep Sea Mining. They harvest polymetallic nodules from the ocean floor. Recent regulatory shifts (Trump administration rules) are clearing the path for commercial permits.

-

The Setup: Cup and Handle with a "Mid Cheat" entry.

TMC

⚡ Clean Tech & Solar

$CSIQ ( ▲ 5.1% ) – Swing trade

-

Context: One of the world's largest solar module manufacturers. They recently won a major patent victory against Maxeon and are seeing solid shipment growth despite the sector slowdown.

-

The Setup: Solar is heating up again.

CSIQ Daily

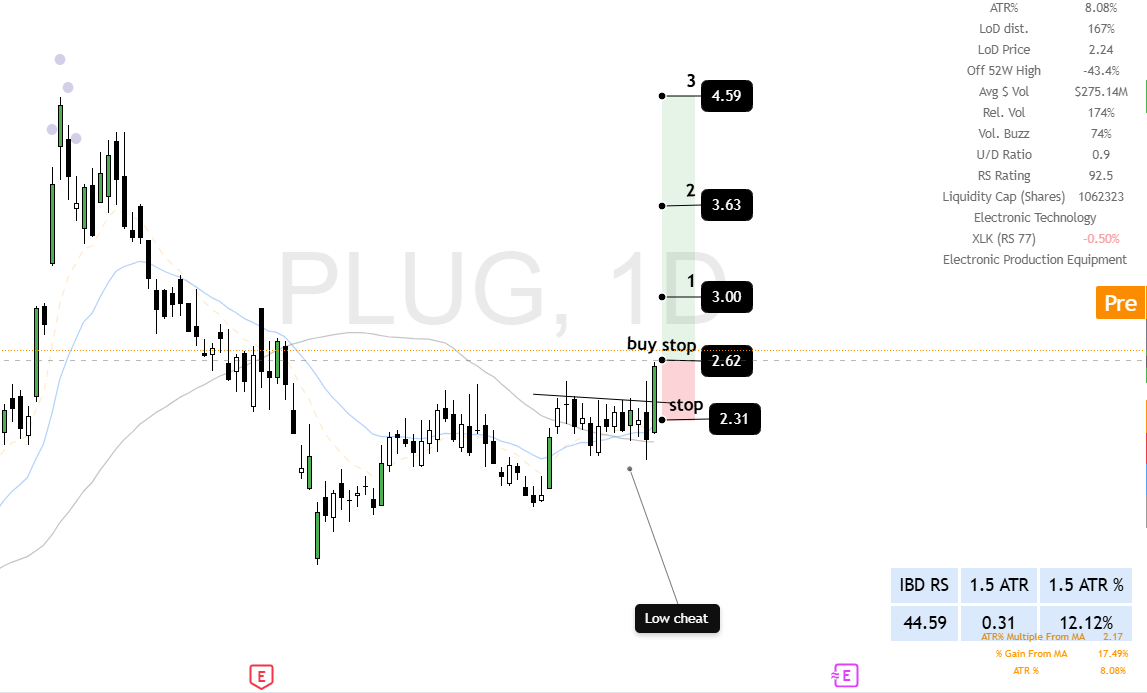

$PLUG ( ▲ 16.67% ) – Swing trade

Context: The leader in Green Hydrogen. They just completed a massive 100MW electrolyzer project at the Galp refinery, proving they can execute on large-scale industrial projects.

PLUG

📊 Trading Framework Reminder

Remember: Every long-term investment alert can also be played as a swing trade.

Long-Term Investors (3-12 Month Holds)

-

Entry: Full position on breakout

-

Profit Taking: Sell 1/4 to 1/5 at Goal 1

-

Exit Signal: Close below 20-day EMA (your trend guide) or 50EMA

-

Why: Strong moves are hard to time at the top, but the 20EMA acts as a reliable trend filter

Swing Traders (2-6 Week Holds)

-

Entry: Full position on breakout

-

Profit Taking: Sell 1/3 at Goal 1

-

Final Exit: Remainder at Goal 2

💬 How Did We Do?

We’d love to hear your thoughts on this week’s alert!

Was it helpful? Did anything stand out to you? Your feedback helps us improve and keep delivering top-tier insights.

👉 If you're enjoying your premium membership, consider leaving us a quick review — it means a lot!

Regards,

Valentine