Don't Fear the Cool Off

4 Breakout setups that ignore the S&P 500.

📰 In This Issue…

The general market has finally cooled off. Good. Amateur traders panic during pullbacks; professionals get their shopping lists ready.

While the S&P 500 takes a breather, a massive rotation is happening under the surface. Capital is flowing out of "overbought" tech and into assets that have zero correlation with the business cycle: Precious Metals, Critical Minerals, and Chinese Tech.

Inside this edition:

-

The Headliner: $SSRM ( ▲ 6.82% ) —The gold miner that just completed a massive 14-week base.

-

The "Critical Mineral" Plays: Why Tungsten ( $ALM ( ▲ 8.88% ) ) and Rare Earths ($USAR ( ▲ 8.54% ) ) are national security trades.

-

🔒 Premium Only: The "China Bounce" adds a low-risk entry to Alibaba, and the contrarian Natural Gas swing.

The broad market is resting. These stocks are sprinting.

🏆 Top Setup of the Day

$SSRM ( ▲ 6.82% ) – Swing trade

The Context: SSR Mining is a major gold producer recovering from a tough 2024. With Gold hovering near all-time highs and their production getting back on track (especially at the Marigold and Seabee mines), the "Turnaround Narrative" is in full swing. The market is finally re-rating this stock to match the metal price.

The Setup: After a tight 14-week consolidation, the stock looks primed to launch. We are seeing classic VCP (Volatility Contraction Pattern) characteristics with clear shakeouts (bear traps) that were immediately bought up.

-

The Trigger: A breakout here confirms the next leg of the recovery.

SSRM Daily

🔒 Below are the Rest of the Market Leaders (Upgrade to Premium to Unlock the Rest of the Alerts)

Commodities

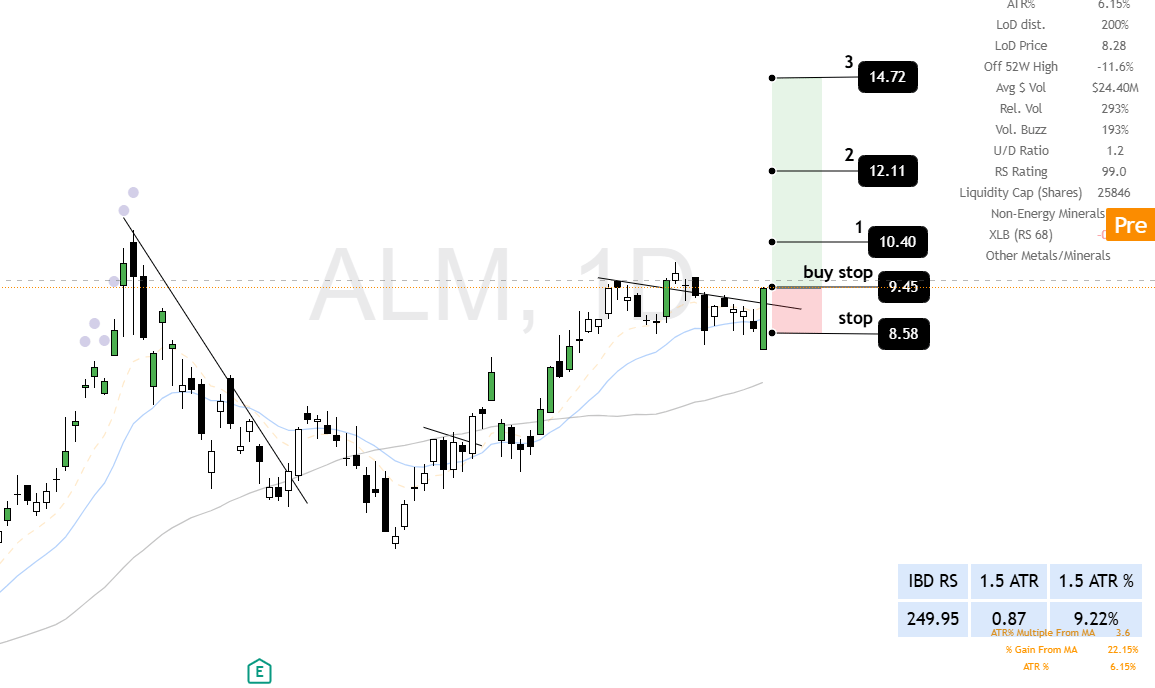

$ALM ( ▲ 8.88% ) – Swing trade

-

Context: Almonty is bringing the massive Sangdong Tungsten mine (South Korea) online. Tungsten is essential for defense (missiles) and industrial tooling, and the West is desperate to reduce reliance on Chinese supply.

-

The Setup: A textbook Cup and Handle formation.

ALM Daily

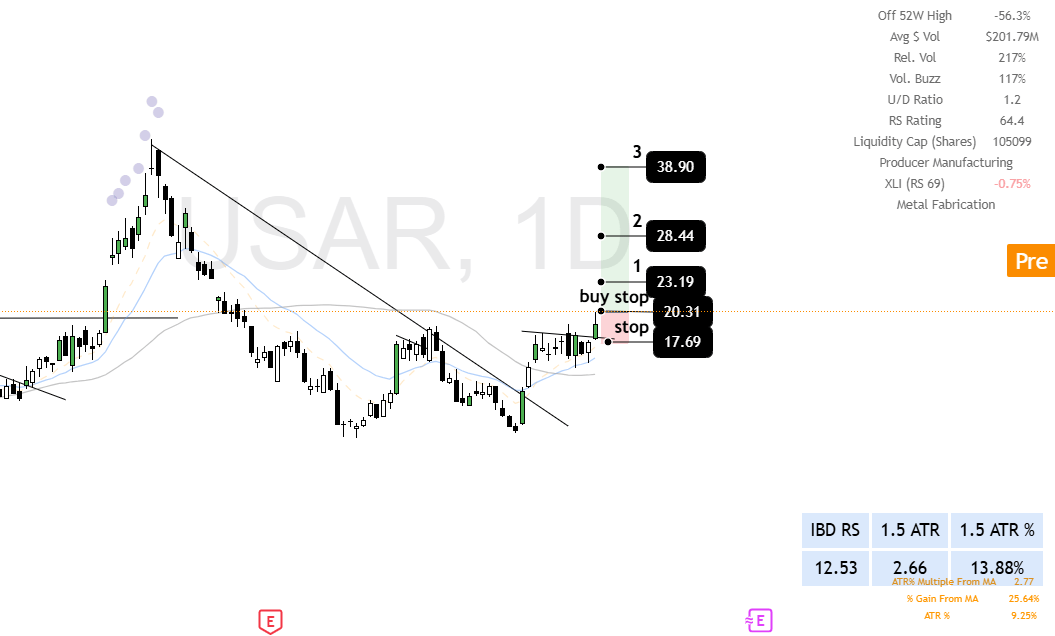

$USAR ( ▲ 8.54% ) – Swing trade

-

Context: A domestic play on the Rare Earth magnets needed for EVs and Fighter Jets. They recently accelerated their commercial timeline and are gaining government support to secure the US supply chain.

-

The Setup: A "Low Cheat" entry (a low-risk entry point deep in the base).

USAR Daily

China Plays

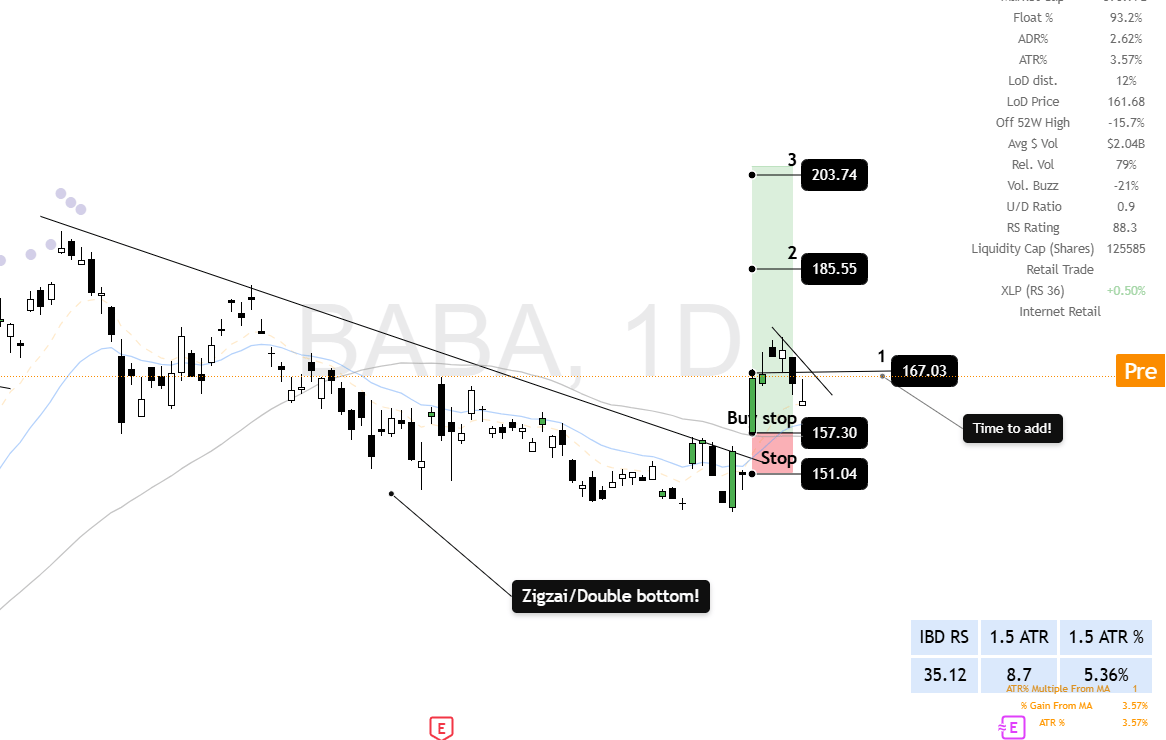

$BABA ( ▼ 1.82% ) – Long term trade

-

Context: The "China Recovery" is real. Alibaba's cloud revenue is surging (+34%), and the company is aggressively buying back shares.

-

The Setup: We caught the original breakout, and now we have a gift: A mini-pullback to the 10-day EMA.

-

Strategy: This is a low-risk spot to add to your position or start a new one. The trend is your friend.

BABA Long term trade

Energy

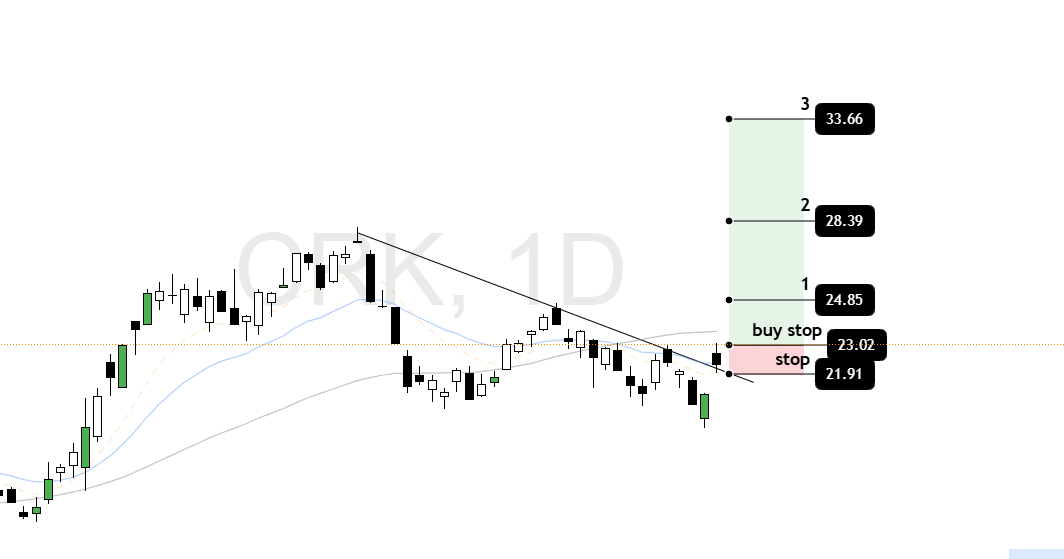

$CRK ( ▲ 5.19% ) – Swing trade

-

Context: A major Natural Gas producer in the Haynesville shale. While gas prices have been choppy, $CRK is a high-beta play on a gas price rebound or a short squeeze (due to high short interest).

-

The Setup: A technical bounce play. Keep stops tight as this correlates heavily with the commodity price.

CRK Daily

📊 Trading Framework Reminder

Remember: Every long-term investment alert can also be played as a swing trade.

Long-Term Investors (3-12 Month Holds)

-

Entry: Full position on breakout

-

Profit Taking: Sell 1/4 to 1/5 at Goal 1

-

Exit Signal: Close below 20-day EMA (your trend guide) or 50EMA

-

Why: Strong moves are hard to time at the top, but the 20EMA acts as a reliable trend filter

Swing Traders (2-6 Week Holds)

-

Entry: Full position on breakout

-

Profit Taking: Sell 1/3 at Goal 1

-

Final Exit: Remainder at Goal 2

💬 How Did We Do?

We’d love to hear your thoughts on this week’s alert!

Was it helpful? Did anything stand out to you? Your feedback helps us improve and keep delivering top-tier insights.

👉 If you're enjoying your premium membership, consider leaving us a quick review — it means a lot!

Regards,

Valentine