7 Stocks Ready to Pop 💥

Why money is rotating into these 3 forgotten sectors.

📰 In This Issue…

If you want the biggest gains, you don't chase what already ran—you position yourself where the money is going.

The "Easy Money" has rotated. The momentum is shifting from over-extended tech stocks into Real Assets and Recovery Plays. Currently, the 5 strongest industries on our radar are:

-

Gold & Silver (Inflation hedge)

-

Electronic Components (AI Hardware)

-

Semiconductors (AI )

-

Commodities (Aluminum, Copper, Uranium)

Inside this edition:

-

The Headliner: $SES ( ▲ 6.94% ) —The AI battery play that is finally ready to move.

-

The "Miner to AI" Pivot: Why Crypto miners are the new Data Center powerhouses.

-

🔒 Premium Only: The "Fallen Angels" (IPOs & Real Estate) that are forming massive bases and waking up.

Most opportunities right now are Swing Trades. Long-term investors: Sit on your hands and wait for the fat pitch.

🏆 Top Setup of the Day

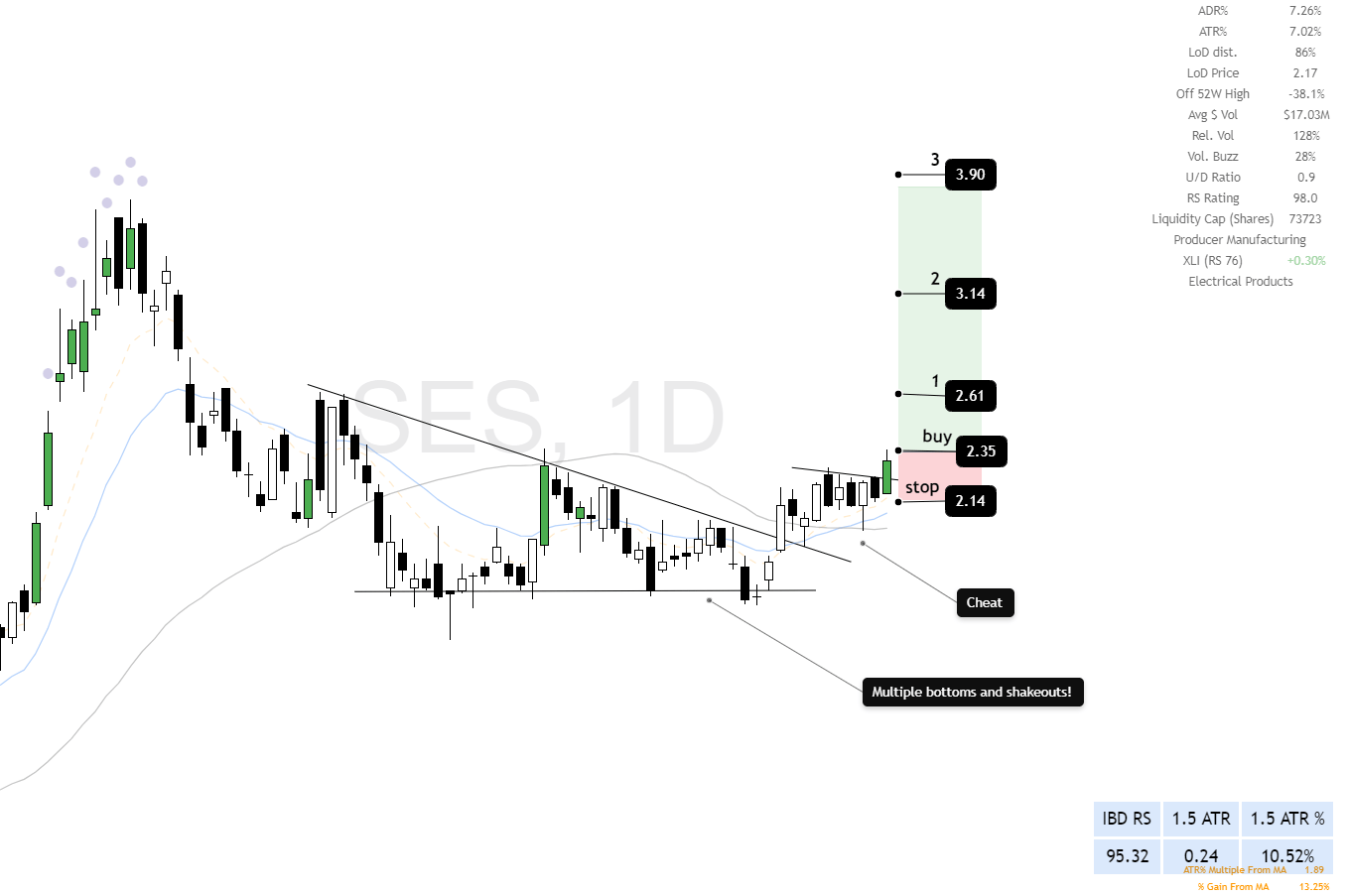

$SES ( ▲ 6.94% ) – Swing trade

The Context: SES AI is a leader in high-performance Li-Metal batteries for EVs and urban air mobility (drones). They are heavily backed by major automakers (GM, Hyundai) and are using AI to solve the "safety vs. density" battery problem.

-

Why it matters: This is a high-beta speculation on the future of energy storage.

The Setup: The stock has been beaten down but is showing signs of a reversal.

-

Strategy: Swing Trade only. Volatility is high, so keep your stops respected.

SES AI

🔒 Below are the Rest of the Market Leaders (Upgrade to Premium to Unlock the Rest of the Alerts)

🏠 IPOs & Volatile "Recovery" Plays

Context: These stocks were left for dead last year but are now forming massive bases. The risk/reward here is asymmetric.

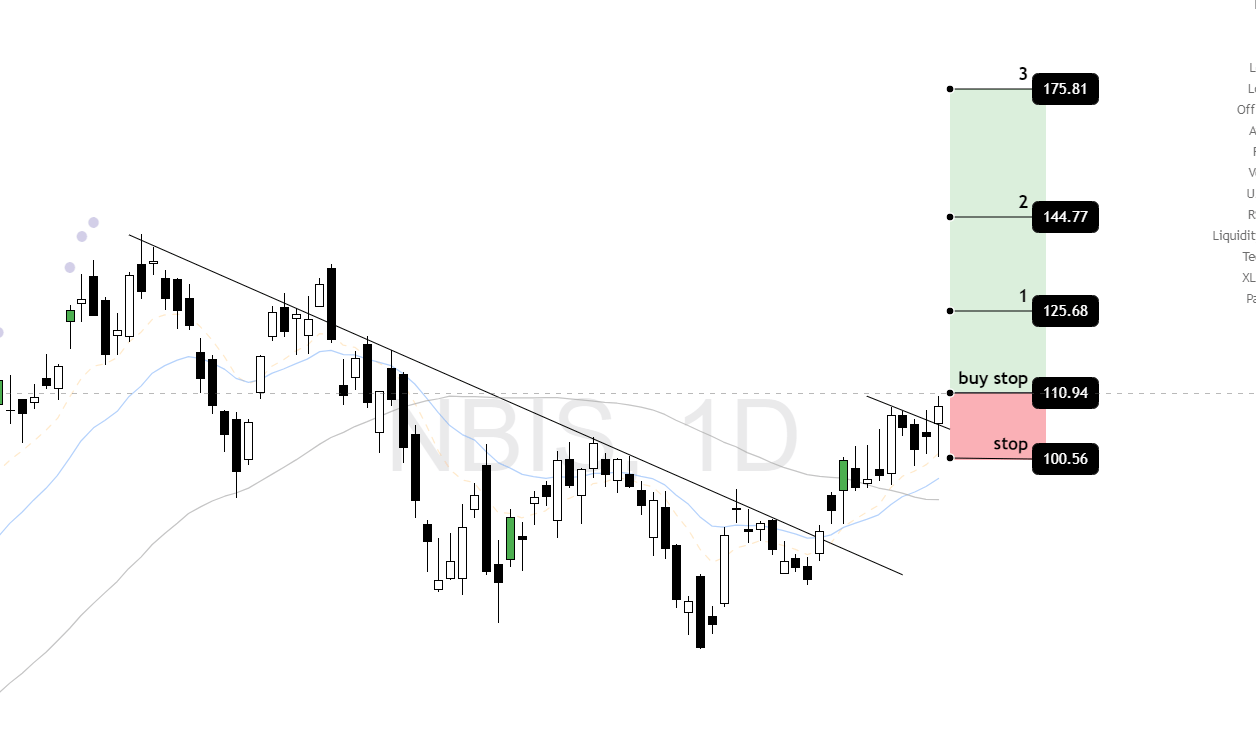

$NBIS ( ▲ 4.66% ) – Swing trade

-

Context: Formerly the tech giant Yandex N.V., Nebius has rebranded as an AI infrastructure company building massive GPU clouds in Europe. They are no longer a "Russian search engine" risk but a pure-play AI cloud provider.

-

The Setup: Emerging from a long consolidation. The "rebranding" narrative is starting to catch on.

NBIS Daily

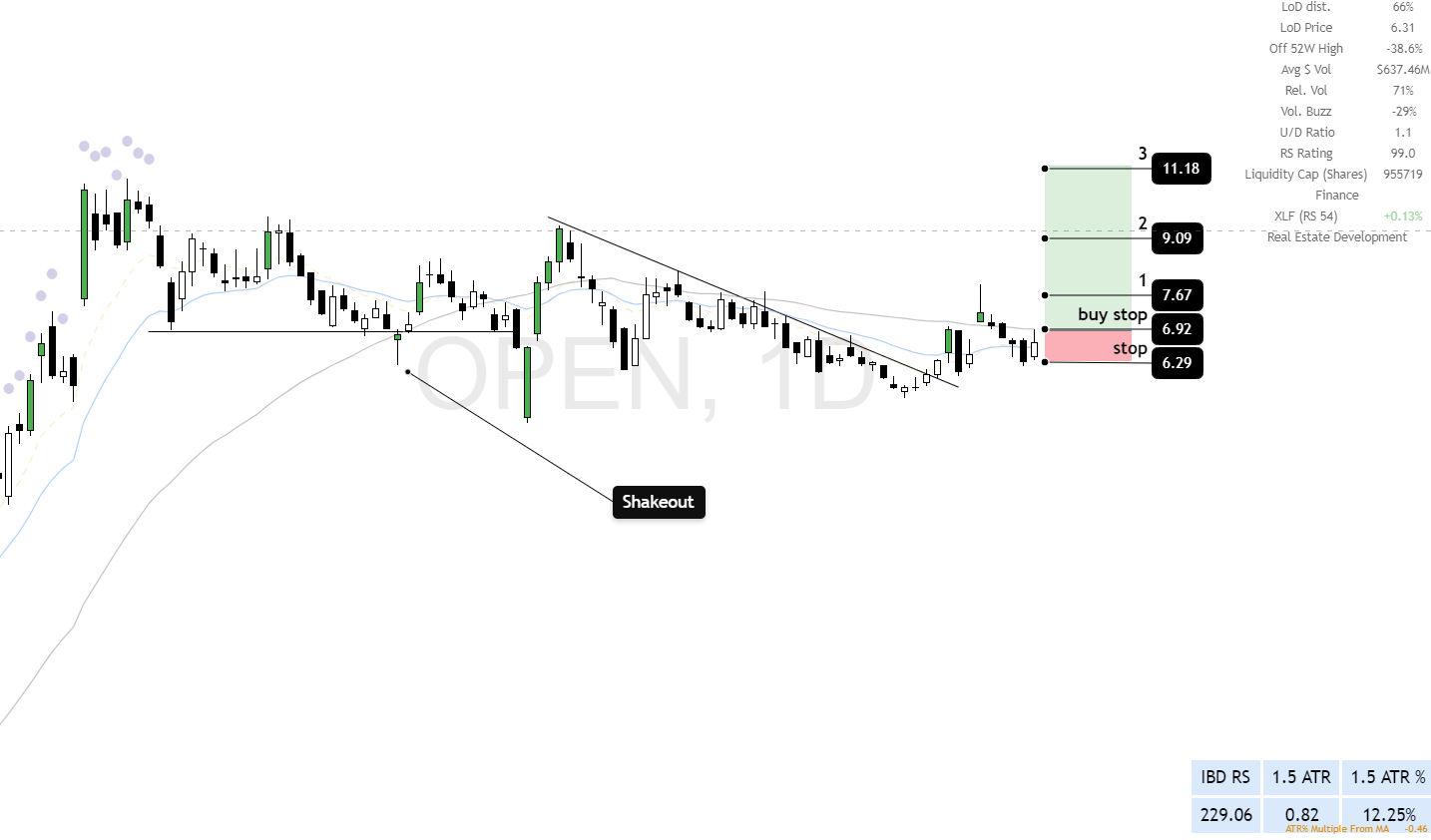

$OPEN ( ▲ 5.87% ) – Swing trade

-

Context: The leader in "iBuying" (digital real estate). As mortgage rates stabilize, their inventory risk drops significantly.

-

The Setup: A massive 16-week base.

-

⚠️ Note: If this breaks out, wait for a close under the 20-day Moving Average to get out, so that you get the best of the move!

OPEN Daily

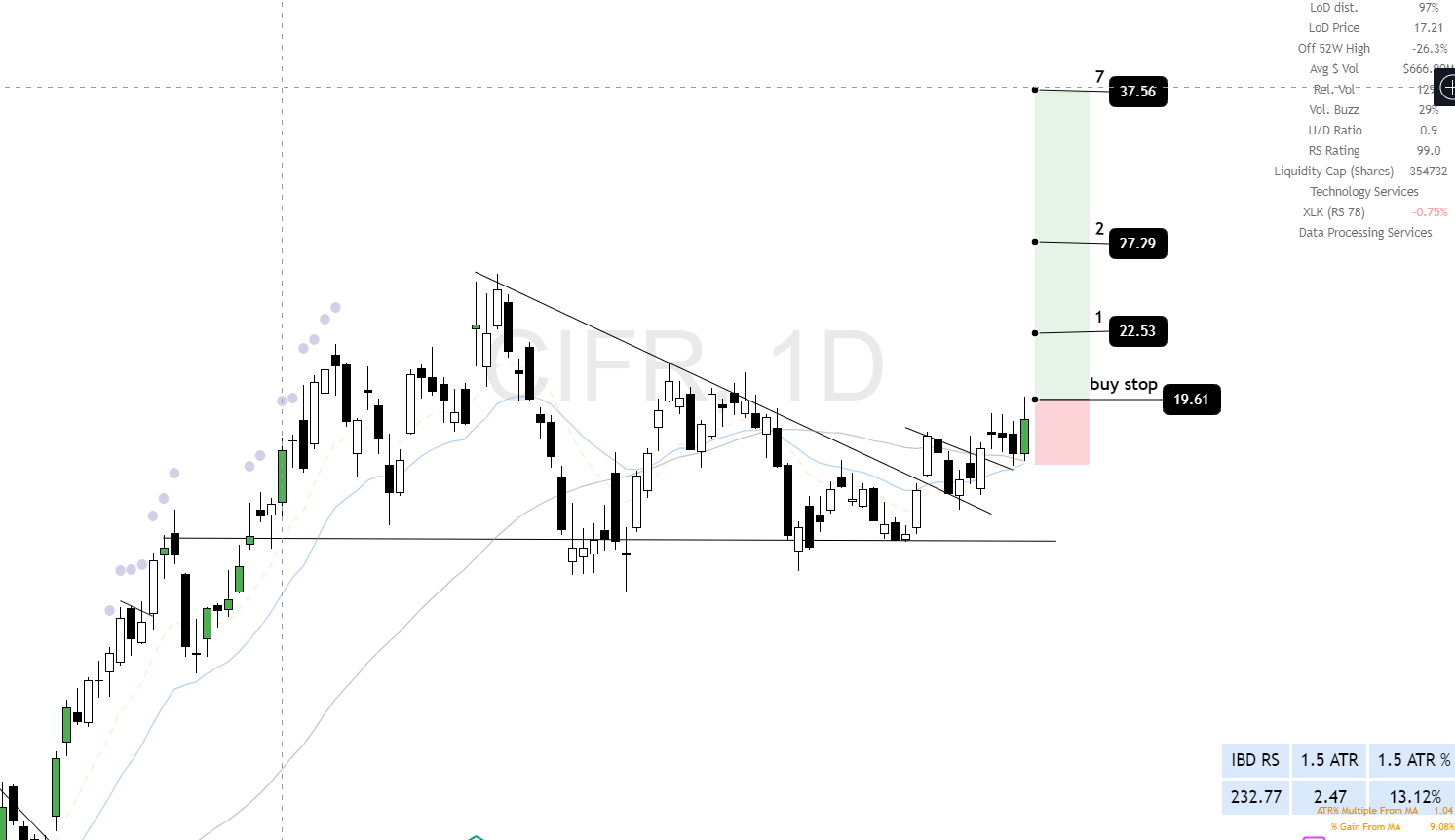

Data processing stocks

Context: This is one of the strongest sectors right now. Crypto miners are rebranding as "High-Performance Computing" (HPC) centers to power AI.

$CIFR ( ▲ 7.31% ) – Swing trade

-

Context: Cipher is pivoting hard to provide power infrastructure for AI data centers. They recently signed massive deals (like with AWS) to lease their power capacity.

-

The Setup: Riding the "AI Infrastructure" hype wave.

CIFR Daily

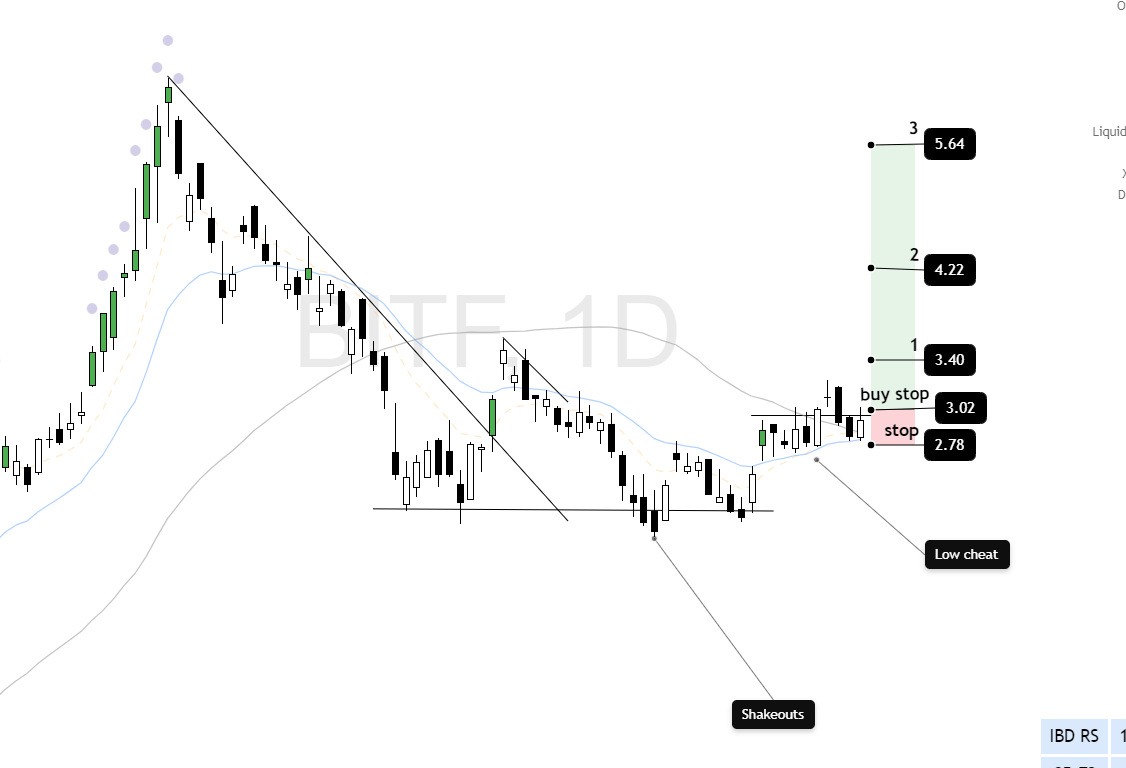

$BITF ( ▲ 3.87% ) – Swing trade

-

Context: Bitfarms is aggressively upgrading its fleet and expanding into the U.S. to capture the same AI/HPC demand.

-

The Setup: A strong technical setup following the sector leader.

BITF Daily

Commodities

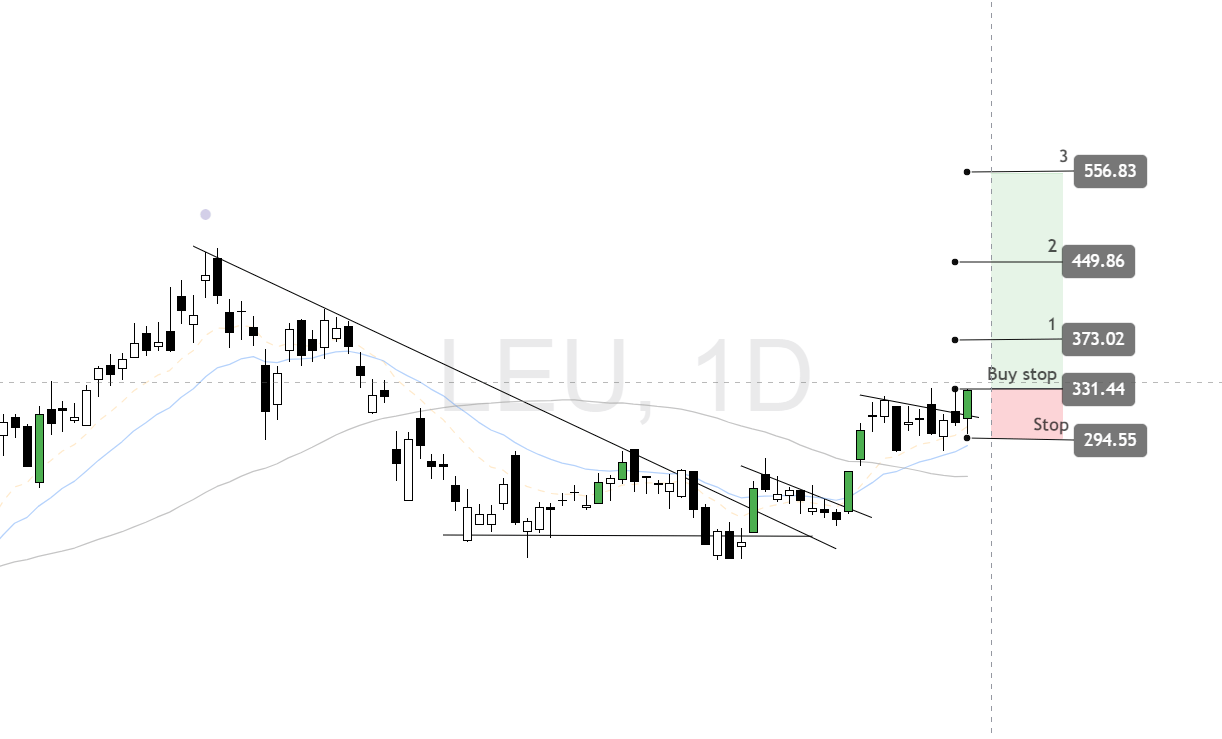

$LEU ( ▲ 8.14% ) – Swing trade

-

Context: Centrus is the primary domestic supplier of enriched uranium (HALEU) for next-gen nuclear reactors. They recently won a massive $900M award from the DOE.

-

The Setup: This is a "Laggard" play. While other uranium stocks ran, $LEU ( ▲ 8.14% ) paused. It is now playing catch-up.

LEU Daily

💰 Finance

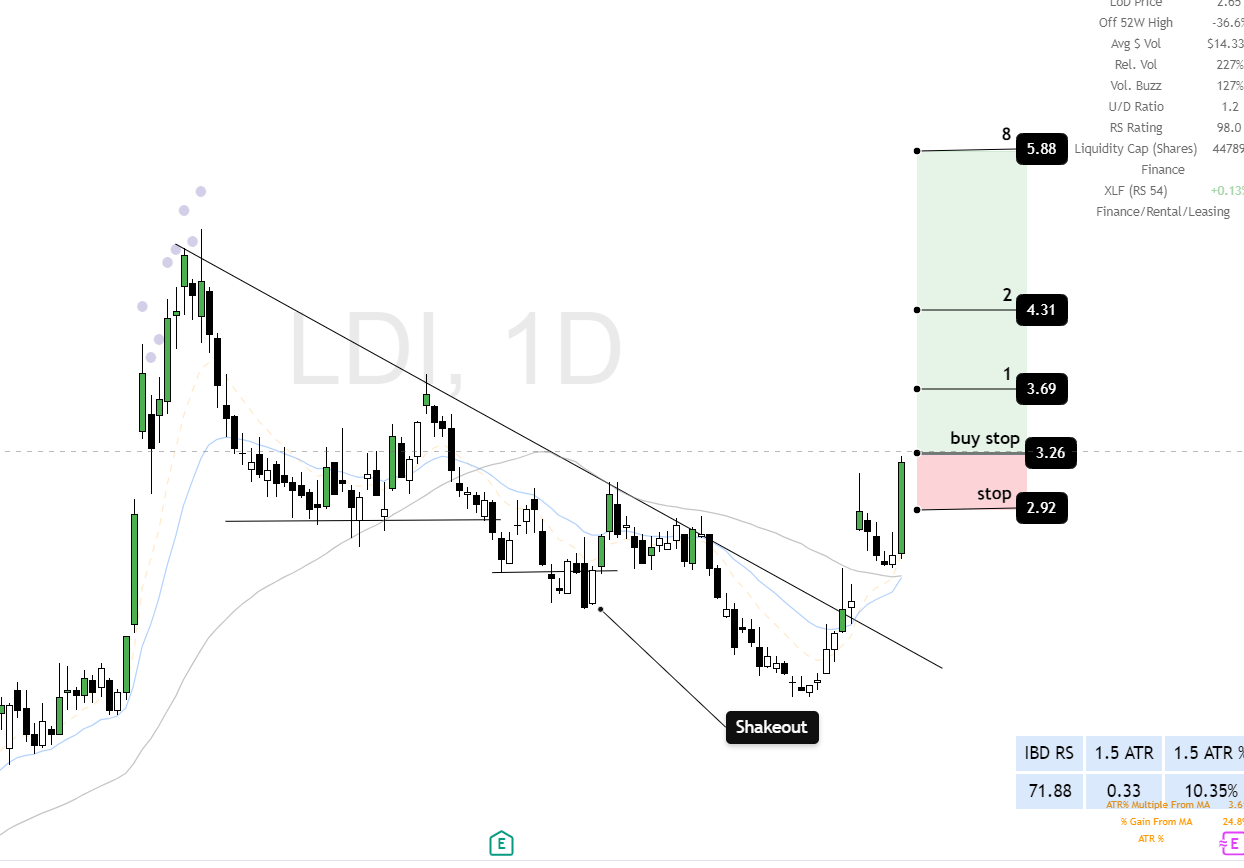

$LDI ( ▲ 19.85% ) – Swing trade

-

Context: One of the largest non-bank mortgage lenders in the US. This is a pure bet on interest rates dropping and the housing market unfreezing in 2026.

-

The Setup: Volatility contraction.

LDI Daily

Energy

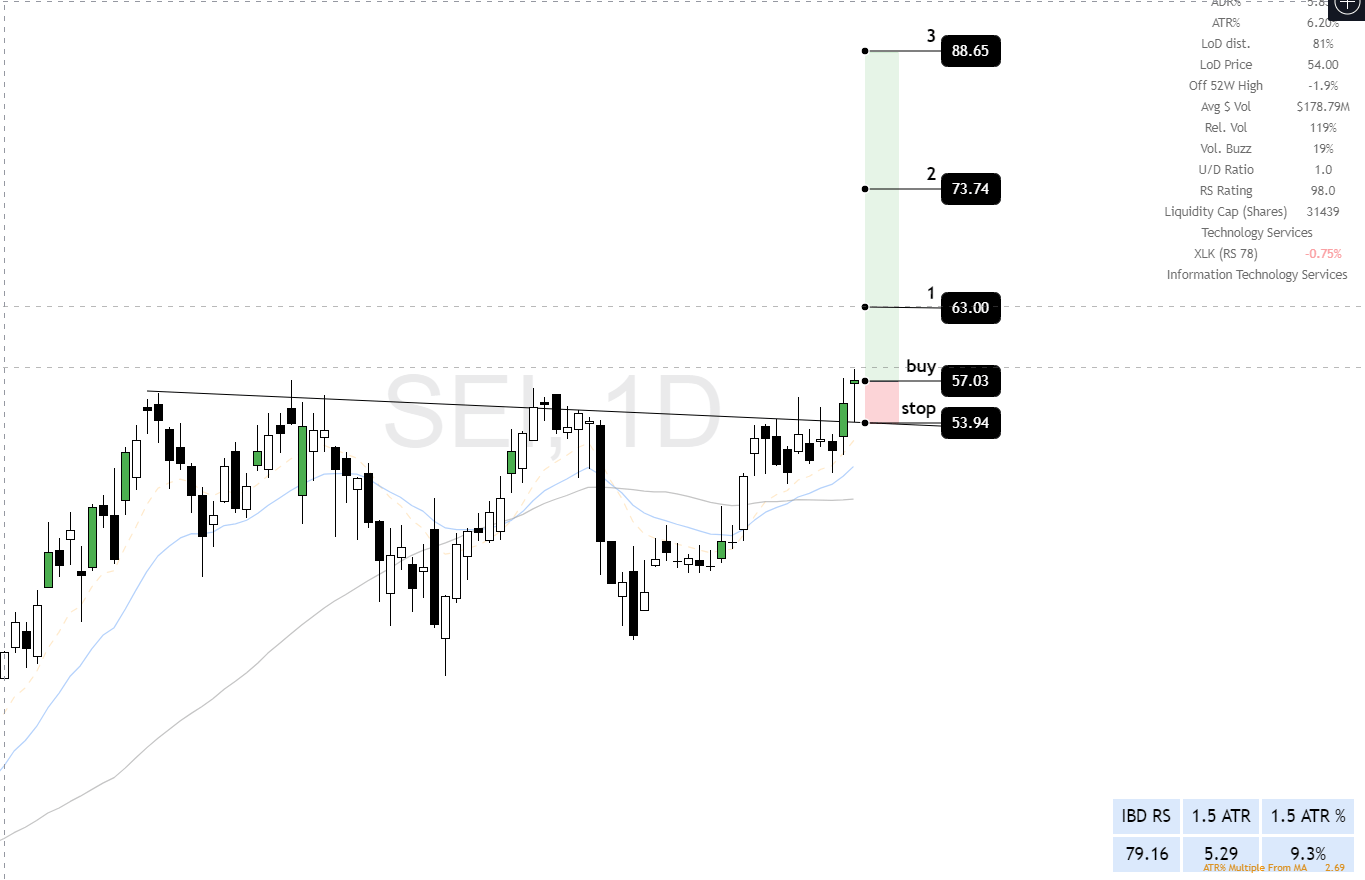

$SEI ( ▲ 2.65% ) – Swing trade

-

Context: Note: This is an Energy stock, not the bank. Solaris provides mobile power infrastructure for oil/gas and data centers. They are a "picks and shovels" play on the energy intensity of AI.

-

The Setup: A clean breakout on volume. This is not the strongest sector overall, so don't go "all in"—but holding a few of these is smart diversification.

SEI

📊 Trading Framework Reminder

Remember: Every long-term investment alert can also be played as a swing trade.

Long-Term Investors (3-12 Month Holds)

-

Entry: Full position on breakout

-

Profit Taking: Sell 1/4 to 1/5 at Goal 1

-

Exit Signal: Close below 20-day EMA (your trend guide) or 50EMA

-

Why: Strong moves are hard to time at the top, but the 20EMA acts as a reliable trend filter

Swing Traders (2-6 Week Holds)

-

Entry: Full position on breakout

-

Profit Taking: Sell 1/3 at Goal 1

-

Final Exit: Remainder at Goal 2

💬 How Did We Do?

We’d love to hear your thoughts on this week’s alert!

Was it helpful? Did anything stand out to you? Your feedback helps us improve and keep delivering top-tier insights.

👉 If you're enjoying your premium membership, consider leaving us a quick review — it means a lot!

Regards,

Valentine