Don't Miss the "Great Reconstruction" Breakout

IBP, Toll Brothers, and the Argentina Banks are running.

📰 In This Issue…

While the market debates the future of Tech, a massive rotation is quietly happening in Real Assets.

Homebuilders are waking up from their slumber, and international money is flooding into the "Argentina Normalization" trade. We are seeing classic technical setups in stocks that build things, finance things, and fix things.

Inside this edition:

-

The Headliner: $IBP ( ▲ 8.23% ) —The "Pick and Shovel" play on the housing boom (it’s not a builder, it’s an installer).

-

The "Macro" Reversal: Why Alibaba ( $BABA ( ▼ 2.27% ) ) is finally a buy again.

-

The Strategy: How to trade the "Cluster Buy" in Argentina Banks.

-

🔒 Premium Only: We unlock the Luxury Builders ( $TOL ( ▲ 7.44% ) ), the Recovery IPOs ( $OPEN ( ▲ 13.38% ) , $BETR ( ▲ 6.49% ) ), and the Industrial Battery play that just flashed a buy signal.

Build your portfolio on a solid foundation.

🏆 Top Setup of the Day

$IBP ( ▲ 8.23% ) – Long term trade

The Context: You can't sell a new home without insulation, gutters, and waterproofing. Installed Building Products ($IBP) is the nation's leading installer of these critical components. They are a "Pick and Shovel" play on the housing market—benefiting from the construction boom without taking on the direct risk of buying land or selling homes.

The Setup: The stock has been grinding higher in a perfect uptrend.

-

Daily: We are seeing tight consolidation near the highs.

-

Monthly: A massive breakout from a multi-year base.

-

Why it matters: When the "Installers" lead the "Builders," the demand is real.

IBP Monthly

IBP Daily

$BABA ( ▼ 2.27% ) – Long term trade

The Context: The Chinese e-commerce giant has been dead money for years, but the tide is turning. With aggressive share buybacks and a cooling regulatory environment in China, $BABA ( ▼ 2.27% ) is pricing in a massive recovery. For more aggressive traders you may use $BABX ( ▼ 4.62% ) which is the X2 ETF of BABA for a bigger move!

The Setup: We are seeing a Monthly Breakout followed by a perfect pullback to test that breakout level.

-

Why it matters: When a stock of this size breaks a multi-year downtrend on the Monthly chart, the move usually lasts for quarters, not days.

BABA Monthly

BABA Daily

🔒 Below are the Rest of the Market Leaders (Upgrade to Premium to Unlock the Home Builders, Argentina Banks, & Recovery Plays)

🏠 Home Builder Stocks

Context: These stocks were beaten down by rate fears last year but are now forming massive bases. The risk/reward here is asymmetric as rates stabilize.

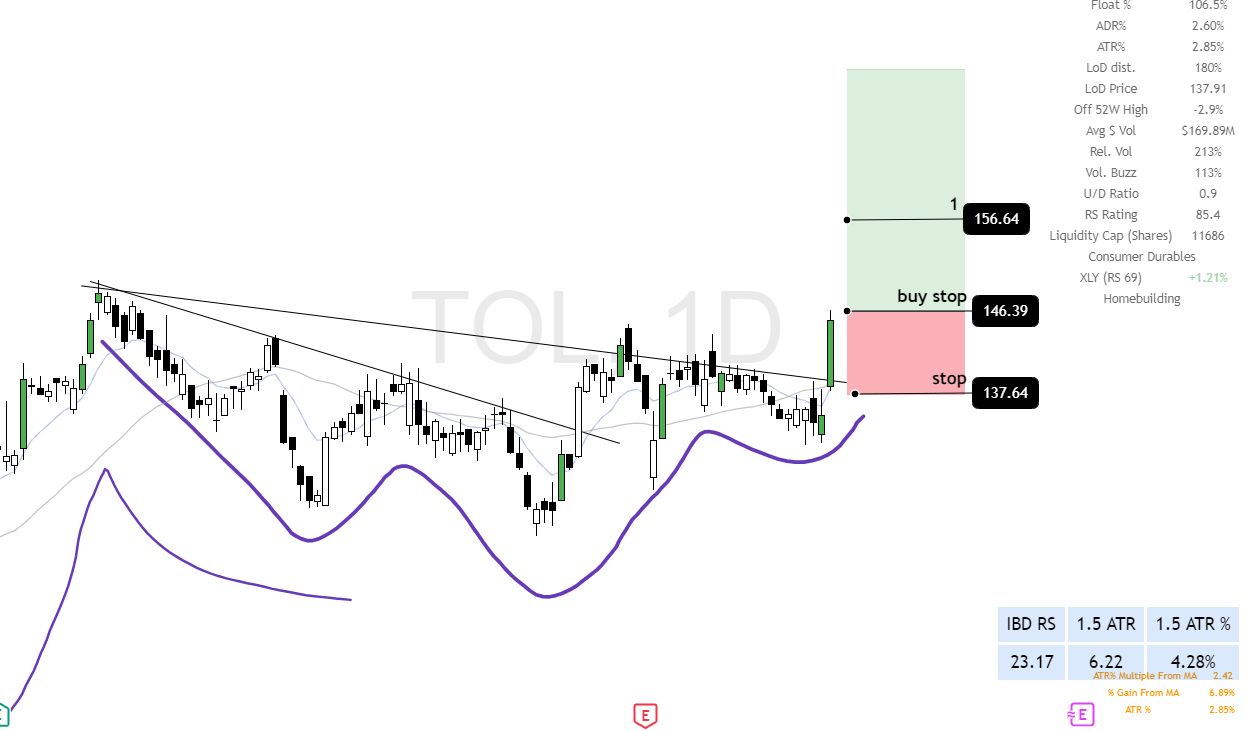

$TOL ( ▲ 7.44% ) – Long term trade

Context: The King of Luxury. Toll Brothers builds high-end homes for wealthy buyers who are less sensitive to mortgage rates. They just announced a strategic pivot to exit the rental market and focus purely on luxury sales.

The Setup: A massive Monthly Cup and Handle. This is a multi-year breakout signal.

TOL Monthly Cup and Handle

TOL Daily

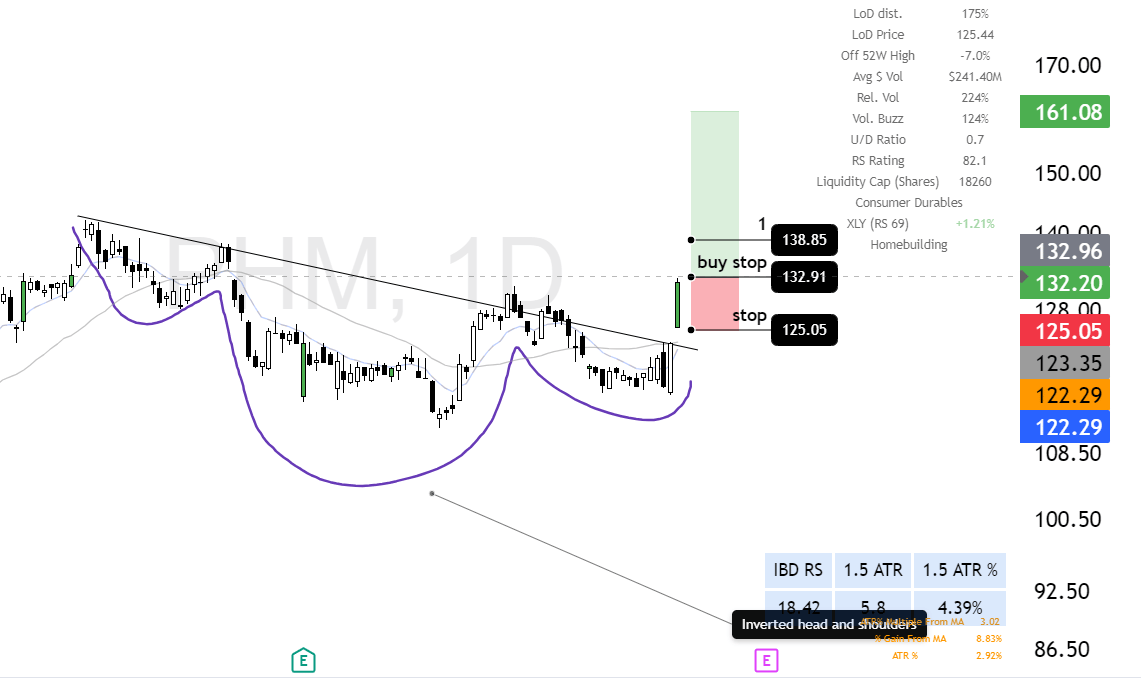

$PHM ( ▲ 7.34% ) – Long term trade

Context: The 3rd largest homebuilder in the U.S., with a massive focus on "Active Adult" (retirement) communities via their Del Webb brand. As Boomers retire, they move into Pulte homes.

The Setup: A massive Monthly Cup and Handle. This is a multi-year breakout signal.

PHM Monthly Cup and Handle

PHM Daily

🏠 Argentina Banking Stocks

Context: The "Argentina Normalization" trade is back. When an entire sector moves together (Cluster Buy), the probability of success skyrockets.

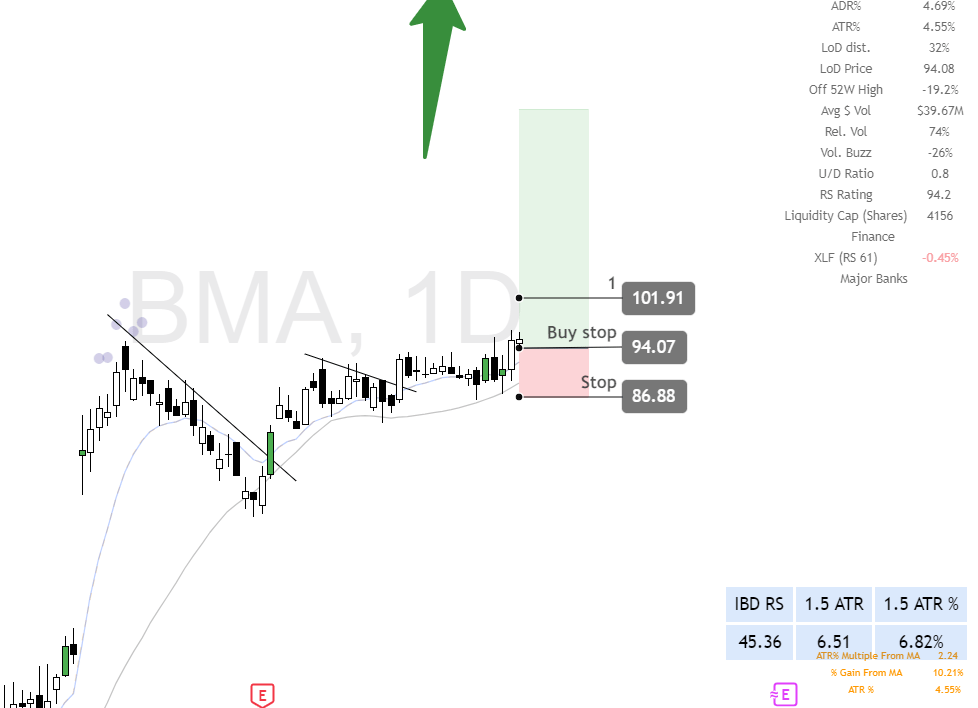

$BMA ( ▲ 0.15% ) – Long term trade

Context: The steady hand. Banco Macro has one of the strongest balance sheets in Argentina and focuses on low-to-mid income retail banking.

BMA Daily

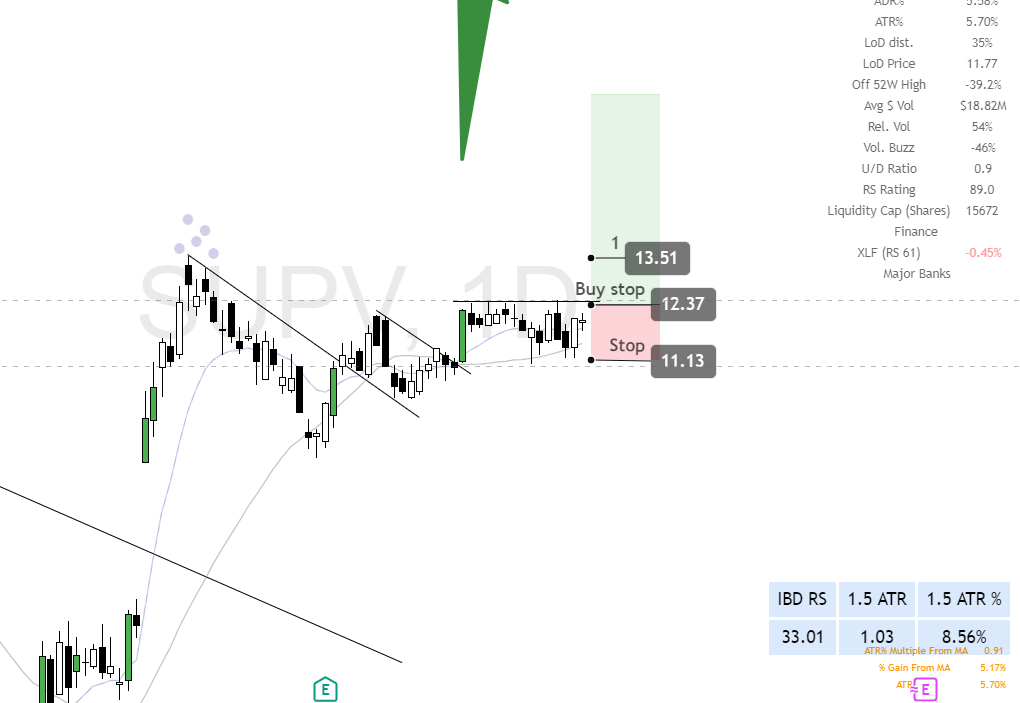

$SUPV ( ▼ 0.33% ) – Long term trade

-

Context: A smaller, high-beta bank that moves fast when the economy improves.

SUPV Daily

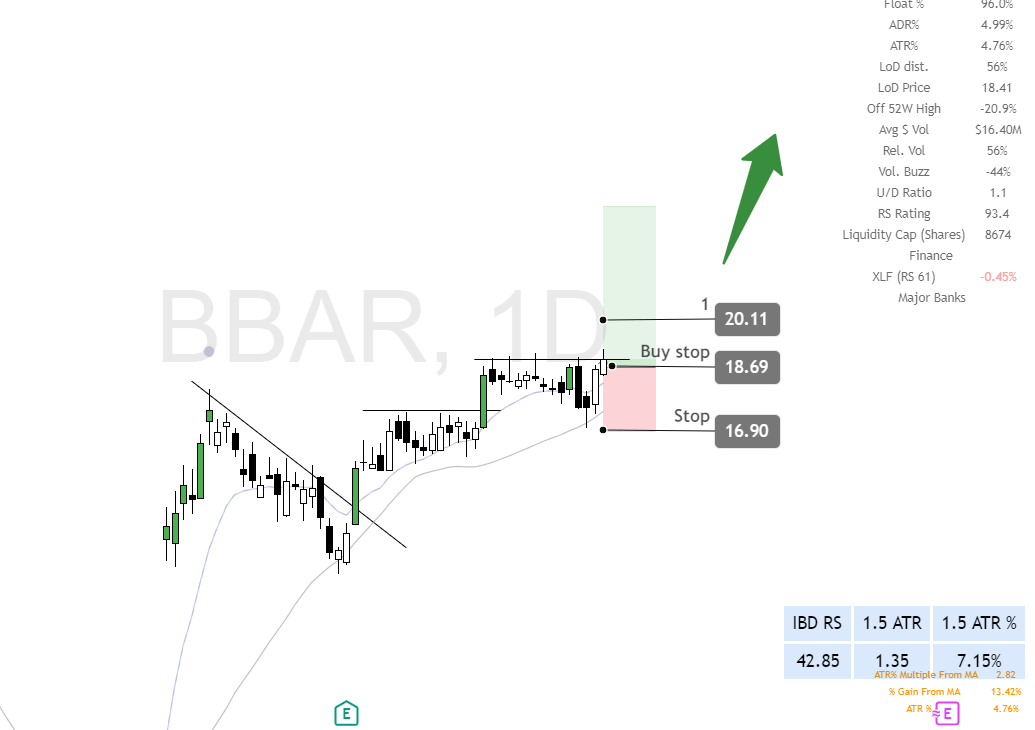

$BBAR ( ▲ 1.61% ) – Long term trade

-

Context: The international player. Backed by the Spanish giant BBVA, it offers stability with emerging market upside.

BBAR Daily

🏠 IPOs & Volatile "Recovery" Plays

Context: These stocks were beaten down last year but are now forming massive bases. The risk/reward here is asymmetric.

$OPEN ( ▲ 13.38% ) – Swing trade

-

Context: The leader in "iBuying" (digital real estate flipping). As interest rates stabilize, their inventory risk drops, and profitability comes back into view.

-

The Setup: A big, long base with clear shakeouts (bear traps). The weak hands are out; now the accumulation begins.

OPEN Daily

$BETR ( ▲ 6.49% ) – Swing trade

-

Context: An AI-native mortgage lender. They use automation to approve loans cheaper and faster than banks. When the housing market thaws, $BETR moves first.

-

The Setup: One of last year's strongest runners is offering a "Low Cheat" entry (a pause within a consolidation)

BETR Daily

$MVST ( ▼ 0.57% ) – Swing trade

-

Context: A leader in battery systems for commercial vehicles (buses, trucks) and energy storage. Unlike flashy EV startups, they focus on the heavy-duty industrial market.

-

The Setup: Another classic bounce off the 30-Week Moving Average.

MVST

📊 Trading Framework Reminder

Remember: Every long-term investment alert can also be played as a swing trade.

Long-Term Investors (3-12 Month Holds)

-

Entry: Full position on breakout

-

Profit Taking: Sell 1/4 to 1/5 at Goal 1

-

Exit Signal: Close below 20-day EMA (your trend guide) or 50EMA

-

Why: Strong moves are hard to time at the top, but the 20EMA acts as a reliable trend filter

Swing Traders (2-6 Week Holds)

-

Entry: Full position on breakout

-

Profit Taking: Sell 1/3 at Goal 1

-

Final Exit: Remainder at Goal 2

💬 How Did We Do?

We’d love to hear your thoughts on this week’s alert!

Was it helpful? Did anything stand out to you? Your feedback helps us improve and keep delivering top-tier insights.

👉 If you're enjoying your premium membership, consider leaving us a quick review — it means a lot!

Regards,

Valentine